European, Asian stocks and S&P futures all dropped after traders were left with a sour taste from the potential fallout of Donald Trump’s order halting some immigration and ahead of central bank decisions from the U.S. and Japan.Markets in Hong Kong, China, Malaysia, Korea, Singapore, Taiwan and Vietnam are all shut due to the Lunar New Year public holiday, leading to a quiet Asian session. Oil rebounded after sliding as much as 0.7%.Gold was unable to hold its overnight gains and has dipped into the red to $1,190 after rising just shy of $1,200 in early trading.

“Concerns on protectionism appear to be rising after President Trump’s executive order to restrict immigration,” said Adam Cole, head of G10 foreign exchange strategy with RBC in London.

As Bloomberg notes, Trump’s executive order halting immigration from seven predominantly Muslim nations drew criticism from world governments and some of the largest companies, bringing the geopolitical and international trade risks surrounding the new U.S. president into sharper focus. As DB’s Jim Reid adds, the domestic affairs of the US hit the headlines all weekend with widespread global criticism and anger over President Trump’s immigration executive order.

The story will likely run and run but will the impact of it spill over into financial markets or will they purely look at the economic implications of a Trump victory and other wider macro issues? It might be interesting to see more responses from Republican members who Mr Trump will need onside for the more direct economic agenda he will soon move on to. While we continue to think a Trump victory likely means higher US growth in 2017 than we would have expected 3 or 6 months ago, we still think volatility will be a feature of the year. It just seems that there are too many uncertainties, unknowns and major policy changes attached to a Trump presidency for it to be a smooth year. Indeed we should note that the VIX (10.57) is at two and a half year lows and within a whisker of post-GFC lows and in reality not far off all time lows. We are comfortably in the lowest percentile of readings of the VIX through history (back to 1987) at the moment so in over 99 days out of every 100 it would normally be higher than this

“Trump always stated these were policies he would implement,” said James Woods, global investment analyst at Rivkin Securities in Sydney. “This renews concerns about a trade war with China that would significantly affect both the Asian and the global economy.”

Not helping sentiment was the veiled hint from last week’s GOP retreat in Philadelphia that the much anticipated Trump tax reform may not hit the 2017 calendar at all, and has been pushed back to the spring of 2018.

In addition to the Trump confusion, traders are on edge ahead of two key central bank meetings this week. The Federal Reserve holds a policy meeting on Feb. 1 and the Bank of Japan convenes this week. Neither is expected to change lending rates, though the Fed’s statement will be parsed for any reading on Trump’s impact on the world’s largest economy.

Looking at those markets that were active (and open), the Stoxx Europe 600 Index lost 0.6 percent at 8:22 a.m. in London in a second day of declines. The S&P 500 futures dropped 0.3 percent after the S&P 500 gained 1% last week. Japan’s Topix index slid 0.4% led by a drop in banks and exporters. The gauge advanced 1 percent last week, trading near the highest since December 2015. Australia’s S&P/ASX 200 Index lost 0.9 percent, dragged down by technology shares.

After oil initially fell as much as 0.7%, weighed down by the reduced appetite for risk resulting from the immigration curbs and by signs of rising U.S. oil output, crude has since rebounded in a rapid move higher without any fundamental news flow to justify the bounce. Data from Baker Hughes showed U.S. drillers added 15 oil rigs last week, taking the total to its highest since November 2015. Copper fell 0.1 percent to $5,893 a tonne, with trade also thinned by the week-long new year holiday in China.

The premium investors demand to hold French 10-year bonds rather than German hit its widest in three years after a poll on Sunday showed Fillon, embroiled in a scandal over allegations of misuse of public funds, losing ground to centrist candidate Emmanuel Macron. Both candidates are ultimately expected to beat far-right candidate Marine Le Pen if either faced her in a run-off.

Signs of accelerating inflation in Germany, which is expected to print at 4 year highs upping the pressure on the ECB to taper its QE program, pushed yields on euro zone government bonds higher. French 10-year yields hit a 16-month high in early trade after an opinion poll showed conservative presidential election candidate Francois Fillon, the favorite to win the vote, losing ground. German 10-year yields turned higher and were up 2.6 basis points at 0.49 percent after regional data lifted expectations of a pick-up in inflation in Germany as a whole. Consumer prices rose 2.3 percent year-in-year in Saxony this month. National data due at 1300 GMT is expected to show German inflation rose to hit the ECB’s 2 percent target. U.S. Treasury 10-year yields rose two basis point to 2.489 percent. The yield on 10-year Australian government bonds slid 6 basis points to 2.72 percent.

* * *

Bulletin headline wrap from RanSquawk

- European equities start the week on the backfront as Europe reacts to President Trump’s executive order and firm regional German CPI

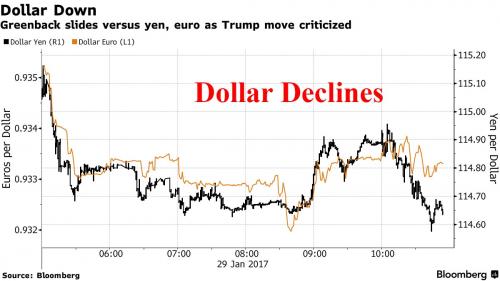

- Thin markets saw the greenback being offloaded, but this has only served to give USD dip buyers better levels as EUFt/USD, USD/JPY and USD/CHF are back to rates seen Friday

- Looking ahead, highlights include German regional and national CPI, US PCE, personal spending, pending home sales

Market Snapshot

- S&P 500 futures down 0.3% to 2,283

- MXAP down 0.3% to 141.61

- MXAPJ down 0.5% to 451.80

- Nikkei down 0.5% to 19,368.85

- Topix down 0.4% to 1,543.77

- Sensex down 0.1% to 27,849.56

- Australia S&P/ASX 200 down 0.9% to 5,661.52

- Kospi up 0.8% to 2,083.59

- German 10Y yield rose 2.1 bps to 0.483%

- Euro down 0.07% to 1.0692 per US$

- Brent Futures down 0.4% to $55.29/bbl

- Italian 10Y yield fell 0.7 bps to 2.227%

- Spanish 10Y yield rose 6.5 bps to 1.652%

- Gold spot down 0.2% to $1,188.63

- U.S. Dollar Index up 0.05% to 100.58