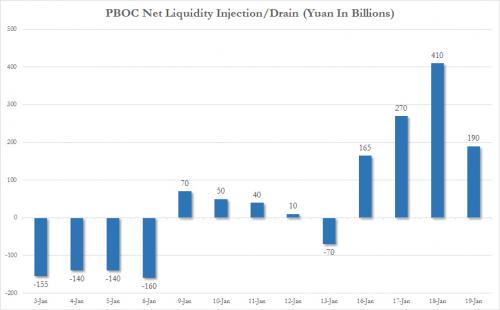

What a difference three weeks makes. On January 18, heading into the Lunar New Year holidays, we reported that the PBOC had injected a record 1.04 trillion yuan into the liquidity-starved banking system in an attempt to avoid a liquidity crunch as telegraphed just days prior by dramatic surge in short-term repo rates.

Since then, however, between the end of the holidays, and the stated Chinese intention to tighten the monetary system, things have changed drastically.

First of all, last Friday, China announced an unexpected tightening of policy when it raised rates on 7, 14 and 28-day reverse repos by 10bps to 2.35%, 2.50% and 2.65% respectively. That was first increase in the 28-day contracts since 2015 and since 2013 for the other two tenors. As this was the first working day following the New Year holiday in China, it was a decent “statement of intent” by the PBoC.

At the same time, as we explained on Sunday, in a parallel tightening episode, the PBOC also increased Standing Lending Facility rates on overnight/7-day/1-month tenors by 35bp/10bp/10bp (to 3.10%/3.35%/3.7%), sending Chinese government bond futures sliding as fears rose that China is actually serious about tightening this time.

Then on Thursday morning, an article in China’s Securities Journal said that China may keep tightening monetary policy this year amid pressure from yuan rate stabilization, financial de-leveraging, curbs on real estate and faster inflation. In other words, China may have reached the phase where it admits it has a problem, and is ready to do something about it. What was notable is that the article hinted that while even more could be done, the economic basis and inflation situation don’t yet support China entering interest rate hike cycle.

Translation: if inflation picks up more from here, the PBOC will use the shotgun approach and hike rates. For now however, the piece concluded that the central bank is focusing more on price tools, which means “an increase in open market rates may be considered guidance.”