European, Asian stocks declined, halting a global rally that sent U.S. stocks surging to new all time highs faltered, weighing on the S&P although the index rebounded modestly after a kneejerk announcement lower overnight after Trump’s National Security Advisor announced his unexpected resignation.

The dollar dropped versus most of its Group-of-10 peers ahead of uncertainty surrounding Fed Chair Janet Yellen’s testimony to Congress later Tuesday, while the pound declined after U.K. consumer-price inflation data missed economists’ forecasts. Oil gains, copper advances. Treasuries steadied. As a result, the DXY dipped 0.2 percent against a basket of currencies to 100.74 but was still near its strongest since Jan. 20, while the euro was 0.3 percent firmer after three sessions of losses to stand at $1.0626. Against the yen, the dollar weakened 0.2% on the day to stand at 113.38 yen, off Monday’s high of 114.17 but well above a 10-week low of 111.59 yen touched a week ago.

Adding to pressure on the dollar was the resignation of President Donald Trump’s national security adviser Michael Flynn, who quit over revelations he had discussed U.S. sanctions against Moscow with the Russian ambassador to the United States before Trump took office, and misled Vice President Mike Pence about the conversations.

As Reuters notes, the prospect of Trump-led economic stimulus in the United States has underpinned the dollar and stocks in recent days, powering U.S. equity markets to record highs on Monday and helping Asian shares to eke out 19-month peaks on Tuesday. But the buoyant mood in global markets was tempered somewhat as attention turned to semi-annual testimony by Yellen on Tuesday and Wednesday that could highlight the likelihood of two or more U.S. interest rate hikes this year.

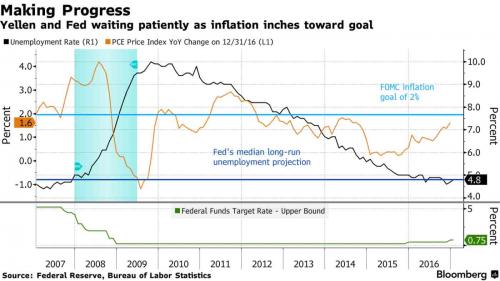

Attention now shifts to Yellen’s first Congress appearance since Trump was sworn in, as investors seek clues on whether the Fed will accelerate monetary tightening to make way for the administration’s promised fiscal stimulus.The market will be hoping Janet Yellen doesn’t ruin Valentine’s Day as today marks her semi-annual testimony to the Senate Banking Panel before she repeats it tomorrow to the House Financial Services Committee. There are probably too many unanswered questions of the new Trump administration’s fiscal plans and also not enough additional hard data to make Yellen deviate much from her January 19th speech and the February 1st FOMC statement. The testimony might instead be used to emphasise that the economy is close to reaching its dual mandate goal and it’s possible that we also get a repeat of the “every meeting is live†mantra, although it would be surprising if Yellen signaled strongly about a March rate hike. Perhaps the most interesting part for markets might be what Yellen says about the Fed’s balance sheet, which as we know has been a topical discussion among policymakers of late and also drawn scrutiny from congressional Republicans in the past. The testimony is scheduled for 10am.

Dallas Fed President Robert Kaplan on Monday argued the Fed should move soon to avoid falling behind the curve, especially as fiscal policy could drive faster growth and inflation.

“If Yellen wants March to be a live meeting as other Fed officials have suggested it is, she will have to adopt a more hawkish tone beyond the usual reference to data dependency,” said ING senior rates strategist Martin van Vliet. “Currently we calculate a market implied probability of around 17 percent for a March rate hike.”

Europe reported Q4 GDP numbers, with German and Italian growth falling short of forecasts, casting doubt on the strength of two of the euro area’s biggest economies amid global uncertainties. German gross domestic product rose a seasonally-adjusted 0.4 percent in the three months through December, while Italian GDP expanded 0.2 percent, according to the nations’ statistics offices. Both figures missed predictions in Bloomberg surveys by 0.1 percentage point.

As Bloomberg adds, while Italy has lagged growth in the 19-nation euro area, Germany — which had annual growth of 1.9 percent last year — has driven Europe’s slow but steady recovery, aided by a weak euro, cheap oil and the European Central Bank’s stimulus policies. While those tailwinds boosted consumer spending and supported exports, rising inflation pressures and uncertain prospects for global trade have cast doubt over whether the pace of expansion can be maintained.

German fourth-quarter GDP was led by domestic demand, the statistics office said. Government spending increased markedly, and households raised consumption slightly. Investment also developed positively, bolstered by building. With imports outpacing exports, net trade was a drag on growth. “The data are alright — German growth is solid, and impulses came exactly from where we expected them to do,†said Marco Wagner, an economist at Commerzbank AG in Frankfurt. “Growth drivers will be similar in 2017.â€

Meanwhile, Europe’s most battered economy, Greece, suffered yet another unexpected economic contraction with Q4 growth dropping 0.4% after 0.9% growth in Q3, suggesting that once again the country’s stuttering bailout talks are doing nothing to help boost the real economy and dimming hopes that growth is finally back on track.

Looking at global markets, the MSCI All-Country index was little changed at 441.02, near its all-time high of 442.70 reached in May 2015. The MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.2 percent, trying for its fifth straight session of gains. Japanese shares ran into trouble after Toshiba Corp delayed an anxiously awaited earnings release. As reported earlier, Toshiba said it would take a 712.5 billion yen ($6.28 billion) writedown on its U.S. nuclear business, wiping out its shareholder equity and dragging the company to a full-year loss. There was also some eye-catching data from China, where producer price inflation picked up more than expected in January to near six-year highs, while consumer price inflation neared a three-year high.