There is an abundance of data that comes from our devices. REITs that own properties used to store this data—like Digital Realty (DLR)—have benefited tremendously from our love of the Internet.

The stock rose 33% in the past one year alone, not including dividends.

Even better, Digital Realty has raised its dividend for 11 years in a row, each and every year since its 2004 initial public offering.

This makes it a Dividend Achiever, a group of 272 stocks with 10+ years of consecutive dividend increases.

Digital Realty last increased its dividend on February 17, 2016.

The company is set to announce fourth-quarter and full-year financial results on February 16 this year. It is likely to announce a dividend increase at that time as well.

This article will analyze Digital Realty’s financial performance since the last dividend raise, and what investors should expect for the 2017 dividend increase.

Business Overview

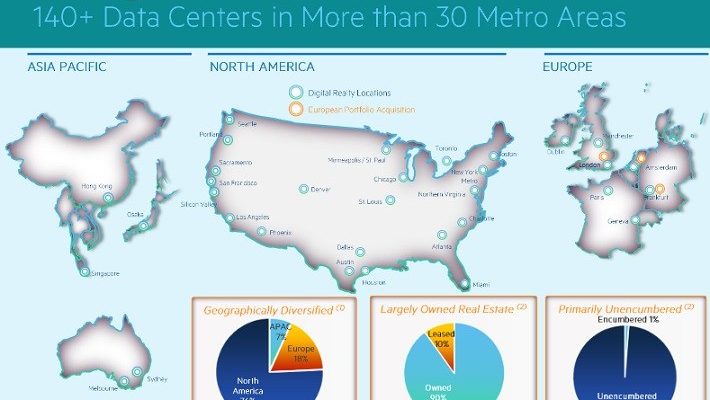

Digital Realty owns a portfolio of turn-key, interconnection, and colocation properties. The company is diversified, both in terms of geographic markets, as well as industries serviced.

(Click on image to enlarge)

Source:Â 2017 Investor Overview Presentation, page 18

Its real estate properties are located around the world. Digital Realty has 199 data centers in North America, 30 in Europe, and 7 in the Asia-Pacific region.It services more than 2,000 customers, from multiple industries.

Digital Realty’s client base is filled with highly stable, established companies.

(Click on image to enlarge)

Source:Â 2017 Investor Overview Presentation, page 19

Digital Realty operates in a high-growth industry. Data storage is booming, which has resulted in consistent growth in lease signings and rental revenue for the past several years.

(Click on image to enlarge)

Source:Â 3Q Earnings Presentation, page 9

Digital Realty’s high-quality tenant base provides the company with steady cash flow. Occupancy stood at 92.6% through the first three quarters of 2016.