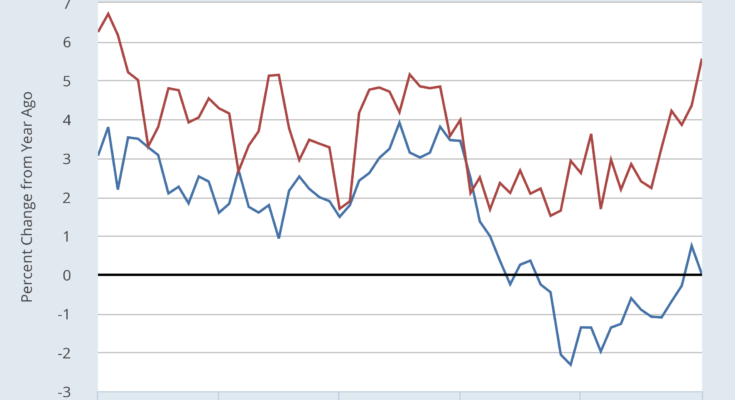

Yesterday’s numbers on economic activity in the retail and industrial sectors is a tale of two trends through January. Consumer spending accelerated to the fastest annual pace in five years while industrial production was flat vs. the year-earlier level. Given the greater influence of consumption for the US economy, the retail data will probably have more sway at the Federal Reserve, which remains on track to continue raising interest rates this year. Another factor that suggests the central bank will continue to tighten policy: consumer inflation at the headline level in January increased to the highest year-over-year rate since 2012.

Will the softer trend in the industrial sector give the Fed pause on deciding to squeeze monetary possible? Maybe not. The main reason that output weakened in January is due to a sharp decline in utility production, which appears to be related to unusually warm weather. Bloomberg advises that January was the 18th warmest month in more than a century according to the National Oceanic and Atmospheric Administration. Keep in mind, too, that manufacturing activity in January was firmer compared with the headline industrial figures. Output among manufacturers increased 0.3% last month vs. a year ago. Although that’s a weak gain by historical standards, it marks the third straight month of positive year-over-year readings.

Meanwhile, headline consumer price inflation increased to a five-year high last month, rising 2.5% in annual terms – the most since March 2012 and above the Fed’s 2% target. Yet the core CPI (less food and energy) still looks stable. Although this measure of inflation’s annual rate ticked up in January to 2.3%, the trend looks contained relative to numbers posted over the past year.The Fed tends to pay more attention to core measures of inflation and so the relatively steady change in this data will take some of the pressure off the Fed to raise rates at next month’s monetary policy meeting.