While we doubt anyone will laugh, we find it amusing that none other than arguably the “last holdout” of ZIRP and then NIRP, BOJ governor Haruhiko Kuroda, finally joined the chorus of people warning that low interest rates will “sow the seeds of the next financial crisis.” Echoing concerns voiced by Deutsche Bank and virtually every other bank over the past year, Kuroda said that “a new challenge has emerged in the form of low profitability at financial institutions,” adding that rapid growth in shadow banking and new financial technology were bringing big changes to the global banking environment.

“These developments suggest that a different kind of financial crisis could happen in the future,” he told an international conference on deposit insurers on Thursday, without elaborating. As Reuters writes overnight, “the remarks contrast with Kuroda’s previous comments emphasizing that the benefits of massive stimulus on the economy make up for potential negatives such as the hit to banks.”

Hoping to spread the blame, Kuroda said the problem of low interest rates hurting bank profitability was a global one, pointing to bad loans piling up at some European banks and headwinds plaguing Japanese banks from sluggish lending driven by an aging population. “For the financial system to ensure future stability, it is becoming more and more important in the long term to think about possible responses to low profitability at financial institutions,” he said.

In other words, Kuroda must have gotten an earful in his last meeting with bank execs.

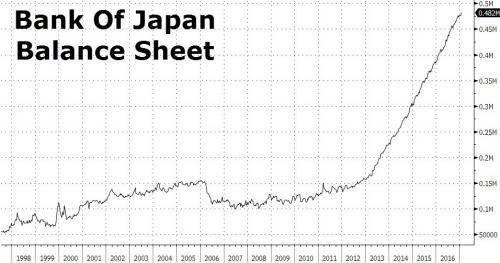

And yet, we said this statement is amusing? Why? Because one look at the BOJ’s balance sheet explains precisely why Japan is currently grappling with trillions in negative yielding bonds.

​

That, and of course the BOJ’s impulsive decision, taken as a result of “peer pressure” suffered during last year’s Davos meeting, to unleash negative rates in Japan for the first time in history.