Over the weekend, Goldman warned that “cognitive dissonance exists in the US stock market” as “investors must reconcile S&P 500’s performance with negative EPS revisions from sell-side analysts.” Specifically, Kostin notes that the “S&P 500 has returned 10% since Election Day while consensus 2017E adjusted earnings have been lowered by 1%”, and predicts that “investors will soon de-rate their expectations of potential 2017 EPS growth as they face the reality that the accretive impact from tax reform will not occur until 2018.”The bank also cautioned that “we are approaching the point of maximum optimism and S&P 500 will give back recent gains as investors embrace the reality that tax reform is likely to provide a smaller, later tailwind to corporate earnings than originally expected.”

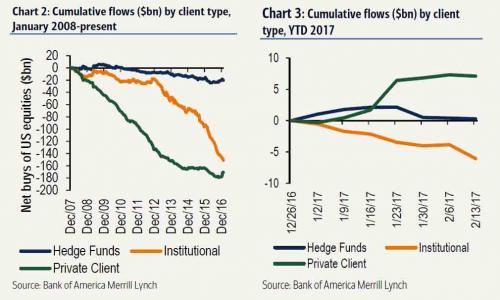

Now, according to the latest weekly BofA client data, “smart money” investors have indeed tempered their euphoric optimism, and last week during which the S&P 500 climbed to another new high, BofAML clients took advantage of the surge in “greater fools” and turned net sellers of US equities for the first time since the week prior to the US election in early November.

(Click on image to enlarge)

BofA’s Jill Carey Hall reports that net client sales of $2.1 billion were the largest since June, with net sales of single stocks eclipsing small net purchases of ETFs. Sales were broad-based across size segments and client types, and this was the first week of selling by private clients since January.

(Click on image to enlarge)

The breakdown:

- Hedge funds have been net sellers of US stocks on a 4-week average basis since early Feb. 2017.

- Institutional clients have been net sellers on a 4-week average basis since early Feb 2016.

- Private clients have been net buyers of US stocks on a 4-week average since early Jan 2017.

- The 4-week average trend for buybacks by corporate clients suggests buyback activity picked up in 4Q, after weak trends in 3Q, but has slowed YTD

(Click on image to enlarge)

Â