One day after the FOMC Minutes guided to a rate hike “fairly soon”, but not soon enough in the eyes of the market (March hike odds dropped after the release), the dollar has posted minimal gains, while global stocks held near record highs on Thursday; S&P futures were fractionally in the green to start the session; crude climbed back above $54 after API showed U.S. stockpiles fell. US and euro zone government bond yields fell or held steady as concerns of an imminent rate hike faded.

The rally that has taken the value of global equities to over $70 trillion and the MSCI All-Country World Index to a record, appears to again be losing momentum as investors grapple with political uncertainty and the Fed’s schedule for lifting borrowing costs. The minutes showed many Fed policymakers said it may be appropriate to raise rates “fairly soon” if jobs and inflation data met expectations. But they also highlighted deep uncertainty over President Donald Trump’s economic program and wrestled with uncertainty on issues ranging from the Trump administration’s fiscal stimulus plans to the headwinds a rising dollar may pose.

Stocks in Europe were mixed in early trading before rising led by telecommunications companies, following solid earnings from Telefonica SA. Bank stocks were stronger on the back of solid earnings from Barclays whose profit before tax of £3.2bn for 2016, rose threefold from the £1.1bn the year before. Its reorganisation has included the sale of its Africa business and selling off “non-core” assets.The STOXX 600 stocks index was marginally higher and close to 14-month highs touched on Tuesday. A 4 percent fall in miner Rio Tinto and a fall of nearly 5 percent in EasyJet, which were among companies whose shares went ex-dividend, weighed on the index.

The MSCI Asia index ex-Japan edged up 0.1 percent, trading near the highest level since July 2015 it hit on Wednesday. Earlier, the index lost as much as 0.15%. Japan’s Nikkei closed fractionally lower, as banks fell, and Australian shares ended down 0.4 percent. MSCI’s world index also nudged higher and was within half a point of Wednesday’s record high.

The dollar edged up less than 0.1 percent against a basket of major currencies but held below highs hit on Wednesday, having fallen immediately after the minutes were released. The euro, which has been buffeted by investor nerves over France’s presidential election, to be held in April and May, was flat at $1.0556. The yen was also barely changed at 113.28. Sterling strengthened 0.2 percent to $1.2468.

As discussed yesterday, in addition to Trump’s policies on taxes, spending and trade, markets are now trying to gauge his attitude to the dollar. Trump said before his inauguration that the dollar’s strength against the Chinese yuan was “killing us”, raising concern in the “strong dollar” policy espoused by recent U.S. administrations could change. However, in an interview with the WSJ, Treasury Secretary Steven Mnuchin praised the strong dollar on Wednesday, saying it reflected confidence in the economy.

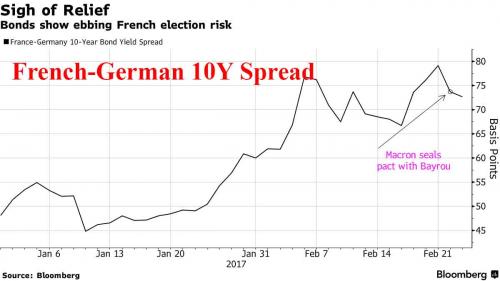

French bonds advanced after a pact between independent presidential candidate Emmanuel Macron and centrist Francois Bayrou, which for now has helped ease fears the country could elect a leader who favors leaving the European Union. “Yesterday’s developments in France were positive for French bonds and broader risk appetite,” said Orlando Green, European fixed income strategist at Credit Agricole in London.

Earlier this morning, French OATs extended gains, led by the 10y-30y sector, as 30y bonds fall as much as 4bps following latest OpinionWay poll showing gains for Macron in second round. Poll shows Macron would beat Le Pen 60%-40% in the second round; that compares with 59%-41% spread in Wednesday’s poll.Italian bonds underperform with 10y yields rising 6bps, leading losses, as concession is built ahead of next week’s supply, which include two issues in the 10y bucket for €2-3BN. German 10Year bonds edged up 1 basis point to 0.28%, having closed on Wednesday at 0.27 percent.

Stronger-than-expected demand at sale of 20-year debt causes Japan’s sovereign curve to flatten; bonds rise in Singapore ahead of this year’s first 10-year sale.

Oil prices rose after data showed a decline in U.S. crude stockpiles as imports fell. Brent crude last traded at $56.56, up 72 cents a barrel. Prices have been rising since the Organisation of Petroleum Exporting Countries and other oil producers agreed output cuts last year. “It’s a battle between how quick OPEC can cut without shale catching up,” said Tony Nunan, oil risk manager at Mitsubishi Corp in Tokyo.

Copper fell almost 1 percent to $5,982 a tonne on concern about fresh regulation that could affect China’s property boom. Gold rose less than 0.1 percent to $1,238 an ounce, supported by uncertainty over the Fed rate outlook. Zinc and nickel also fell more than 1 percent.

Market Snapshot

- S&P 500 futures up 0.1% to 2,362.75

- STOXX Europe 600 little changed at 373.55

- German 10Y yield fell 0.5 bps to 0.274%

- Euro down 0.2% to 1.0542 per US$

- Brent Futures up 1.5% to $56.67/bbl

- Italian 10Y yield fell 5.3 bps to 2.194%

- Spanish 10Y yield fell 0.3 bps to 1.69%

- MXAP little changed at 146.12

- MXAPJ little changed at 470.84

- Nikkei down 0.04% to 19,371.46

- Topix down 0.05% to 1,556.25

- Hang Seng Index down 0.4% to 24,114.86

- Shanghai Composite down 0.3% to 3,251.38

- Sensex little changed at 28,862.89

- Australia S&P/ASX 200 down 0.4% to 5,784.66

- Kospi up 0.05% to 2,107.63

- Brent Futures up 1.5% to $56.67/bbl

- Gold spot little changed at $1,237.58

- U.S. Dollar Index up 0.2% to 101.39