Wisdom & discipline will separate winners from victims

It’s impossible to predict with certainty how much more insane our financial markets will get before an inevitable correction. But my personal bet is:Â A lot!

For my reasons why, take a few minutes to watch the chapter on bubbles below from The Crash Course. For those who haven’t seen it before, the takeaway is this: bubbles pop only when greed in the market has been exhausted:

Bubbles make no sense economically. Or rationally. But they happen all the time as a part of the human condition.

Even while financial bubbles are enabled by dumb monetary and banking decisions, their actual genesis is rooted in primal human emotions. Greed on the way up, and fear on the way down.

The hardest part about these bubbles is not being swept up in them. As the above video shows, history is chock full of asset bubbles. We humans just never seem to learn. Like Charlie Brown’s endless attempts to kick Lucy’s football, we get suckered in by the promise of easy riches, only to end up flat on our back when the market suddenly yanks that promise away.

Wash, rinse, repeat.

Most of you reading this might be thinking “Hey, I’m a reasonable intelligent person. I won’t fall victim to the next bubble.†Perhaps, but maybe not. The numbers say that the majority of you will. Unfortunately, being smart — even a genius — is no protection against being ruined by a bubble.

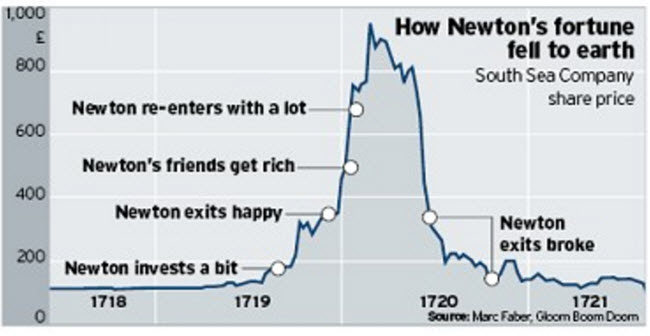

Remember from the video that even Sir Isaac Newton, easily one of the most brilliant humans ever to live, got his clock cleaned by the South Sea Bubble:

(Source)

Bubbles are much easier to enter than to exit. As they build, all your friends and neighbors are diving into the pool and enjoying easy riches. You deserve some of that good fortune, right? And there will be plenty of eager parties willing to help you get on the bandwagon.Â

But when the bubble pops, though, action becomes much harder to take. At first, everyone assumes that the sudden drop is a temporary aberration and that the party will shortly resume. As prices fall further — and they typically fall at a faster rate than when they were rising — folks become paralyzed by fear on the way down, slowly realizing that their paper profits may indeed be gone for good. At first they’re unwilling to give up the dream of the “sure thing” they so recently had, and then, once the losses start mounting, they find themselves resistant to locking in those losses by selling. Instead, they hold on to the increasingly threadbare hope that prices will at least recover to where they can ‘get their money back.’

Of course, that never happens. For all those who bought in during the mania, their money was hopelessly betrayed the moment they placed their bet. And that’s what bubbles are – merely bets. And that bet is: I bet I can get out before everyone else.

That’s mathematically impossible for the majority. It’s really only possible for a very tiny few who have the vision and the discipline (and more often than not, the luck) to pull it off. Very rare are the people who get out at the top.