In my view, T. Rowe Price Group (TROW) stock should be included in every diversified large cap dividend stocks portfolio. The global investment management company T. Rowe Price disclosed last week that its Institutional Large-Cap Growth Fund holds 1.29 million of Snapchat shares valued at $15.30 a share, as of December 31, 2016. The initial public offering of the popular messaging application Snapchat is scheduled on March 1, and according to market sources, the planned $3.2 billion IPO is oversubscribed. According to Reuters, the high demand indicates that Snapchat stocks could trade at a higher price than the estimated IPO price range of $14 to $16 a share, benefitting T. Rowe Price and also the mutual funds run by Fidelity Investments.

Latest Quarter Results

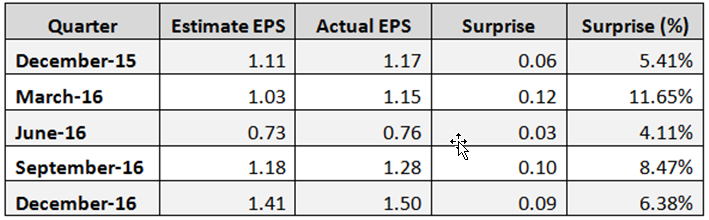

On January 26, T. Rowe Price reported its fourth quarter 2016 financial results, which beat earnings per share expectations by $0.09 (6.4%). TROW’s revenues of $1.1 billion for the quarter were in-line with the consensus estimate. The company showed earnings per share surprise in all its five last quarters, as shown in the table below.

TROW Stock Performance

TROW’s stock has underperformed the market in the last few years. Since the beginning of the year, TROW’s stock is down 4.4% while the S&P 500 Index has increased 5.7%, and the Nasdaq Composite Index has gained 8.6%. Since the beginning of 2012, TROW’s stock has gained only 33.4%. In this period, the S&P 500 Index has increased 88.2%, and the Nasdaq Composite Index has risen 124.4%. According to TipRanks, the average target price of the top analysts is at $82, representing an upside of 14% from its February 24 close price of $71.95, which appears reasonable, in my opinion.

Valuation

As I see it, TROW’s stock is slightly undervalued. The company has no debt at all, its trailing P/E is at 15.08, and its forward P/E is at 14.16. The price to cash flow ratio is at 12.80, and the Enterprise Value/EBITDA ratio low at 8.40.