Three years ago there was outrage among traders when HFT marketmaker Virtu reported that it had managed to log just one day of trading losses in over 4 years of trading. Many speculated that this was proof that HFTs had managed to effectively rig the market in a way that prevents any trading losses. It now appears that Virtu is not the only one with a near-perfect trading record.

Over the past several years, America’s big banks have been loathe to publicly disclose how effective their trading desks are, and as a result several years ago they changed they way they report their “trading losses”, usually adjusting for VaR and market-risk. A quick look at JPM’s most recent 10-K reveals just that. According to disclosure in JPM MD&A, a reader would be left with the impression that JPM’s trading desk is mediocre at best, as a result of the following disclosure:

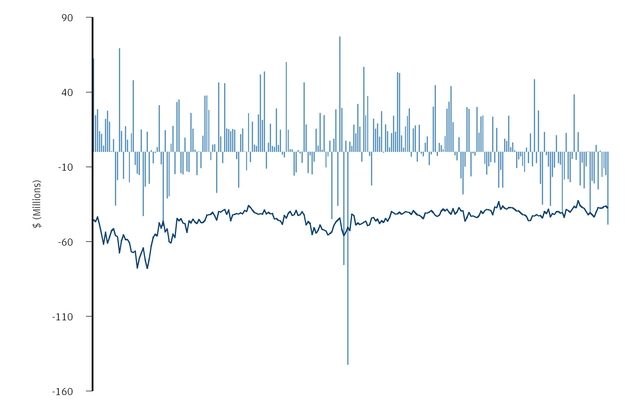

The following chart compares the daily market risk-related gains and losses with the Firm’s Risk Management VaR for the year ended December 31, 2016. As the chart presents market risk-related gains and losses related to those positions included in the Firm’s Risk Management VaR, the results in the table below differ from the results of back-testing disclosed in the Market Risk section of the Firm’s Basel III Pillar 3 Regulatory Capital Disclosures reports, which are based on Regulatory VaR applied to covered positions. The chart shows that for the year ended December 31, 2016 the Firm observed 5 VaR back-testing exceptions and posted Market-risk related gains on 151 of the 260 days in this period.

Â

Naturally, any time banks purposefully “adjust” or otherwise obfuscate a number, it usually means that the actual, unadjusted number reveals a very different picture, and not surprisingly, the same is true regarding JPM’s trading record. Conveniently, during JPM’s investor day yesterday, JPM Investment Bank CEO Daniel Pinto presented a 25 page breakdown which among other things, contained the answer.