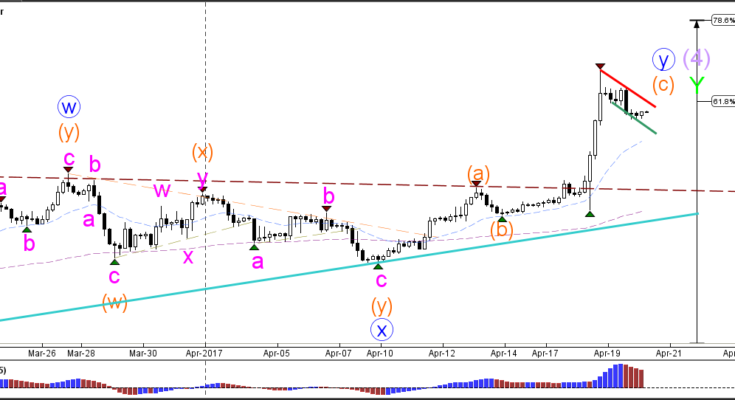

GBP/USD

4 hour

The Members of the British Parliament have approved the Prime Minister’s plan yesterday to organise an early general election on June 8. The vast majority of the Parliament Members approved the motion (522 out of 650) clearing the bar of the two-thirds needed for accepting the plan.

The election news did not impact the GBP/USD as much as it did on Tuesday. The Cable currency moved sideways which is forming a bull flag chart pattern (green/red lines) in the meantime. Price is testing the 61.8% Fibonacci level of wave 4 (purple) and could show one more higher high if it breaks above the bull flag.

1 hour

The GBP/USD retracement has reached the 38.2% Fibonacci retracement level at 1.2750 which could act as a bounce zone if price is indeed in a wave 4 (purple) correction. A break below the 61.8% Fibonacci level makes a wave 4 invalid. A break above the bull flag could see a wave 5 (purple) develop.

EUR/USD

4 hour

The EUR/USD has paused at the 50% Fibonacci retracement level of wave 2 (brown) but a continuation breakout could see price challenge higher Fibonacci levels.

1 hour

The EUR/USD has retraced to the 38.2% Fibonacci level of wave 4 (pink). A break below the 61.8% Fib invalidates the wave 4 (pink) but otherwise a wave 5 (pink) within wave C (purple) is likely to develop.

USD/JPY

4 hour

The USD/JPY is building a potential wave 4 correction (orange), which would become invalid if price retraced above the bottom of wave 1 (red line). A break below the support level (blue) could indicate a bearish breakout and completion of wave 4 (orange).

1 hour

The USD/JPY could be building an ABC (purple) zigzag correction towards the Fibonacci levels of wave 4 (orange) where a break above the resistance level (red) could spark a wave C (purple).