AT40Â = 67.2% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200Â = 65.1% of stocks are trading above their respective 200DMAs

VIXÂ = 10.8 (volatility index)

Short-term Trading Call: bullish

Commentary

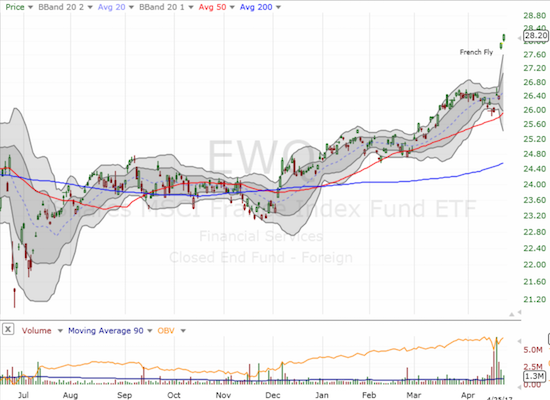

The French Fly continued apace as financial markets continued to celebrate. In The French Fly, I failed to post a chart of the iShares MSCI France (EWQ).Â

Â

The French Fly caused an impressive breakout to a near 3-year high for the iShares MSCI France.

Â

The monthly chart of EWQ shows the tremendous upside potential for EWQ in a recovery scenario.

The major relief from the first round of the French Presidential election, what I call the French Fly, pushed EWQ to a major breakout to a near 3-year high. Yet, as The French Fly in discussing the lack of apparent fear in the euro, EWQ showed very little trepidation about the election. Indeed, going into the election, EWQ bounced near support at its 50-day moving average (DMA) and even at one point traded at a near 3-year high before fading a bit. In other words, I am hard-pressed to find evidence in the expected places that financial markets held authentic fear surrounding events in France. I am even more interested now in the bull story for France, and Europe in general, because of the tremendous upside potential of a growing recovery story.

On the other side of the Atlantic, the U.S. market continued its own celebration as it apparently chose to focus on positive U.S. headlines about tax reform and the likely avoidance of a government shutdown.

With S&P 500 trading well above upper-Bollinger Band, sold $SSO shares and calls. Ref: https://t.co/1IY5TvrkiX $SPY pic.twitter.com/H30qRF8wAj

— Dr. Duru (@DrDuru) April 25, 2017

Â

The S&P 500 (SPY) gained 0.6% and closed above its upper-Bollinger Band (BB). At its height, AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, hit 68.6% before settling in at 67.2%. With the index so stretched at the same time that AT40 traded near overbought levels, I decided it was a good time to lock in profits on my ProShares Ultra S&P500 (SSO) shares and call options. Note well that I remain bullish, but I prefer to to buy the next dip with conditions already looking a bit stretched. Also note that AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, closed at a new 6-week high and broke out above a wide trading range.