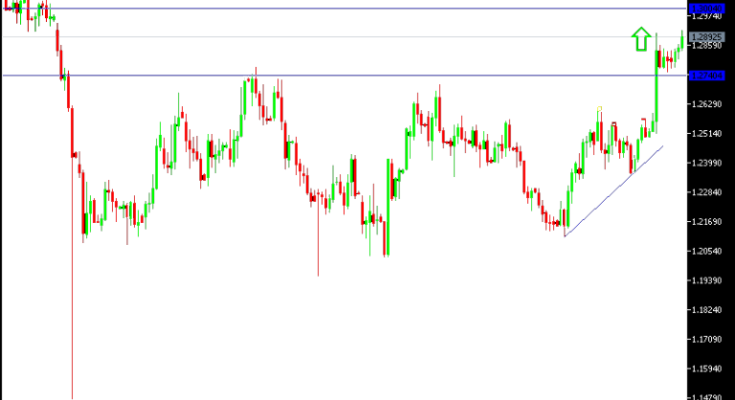

At the beginning of Thursday trading, the GBP/USD pair shot up achieving strong gains up to 1.2917, before settling around 1.2897 at the time of writing. Amid continued bullish momentum for the pair since the surprising announcement by the UK P.M of the early elections to support the stability in the country in the post Brexit stage, which should enable a smooth exit. This reason was the strongest to achieve the GBP gains, and despite negative economic data from the UK recently, the expectations of a smooth exit stayed a strong factor for the pair to maintain the gains. The lack of clarity towards Trump’s policies, even after yesterday’s announcement by Trump Administration regarding the Tax Plans to reduce corporate and individual taxes, was vague and didn’t present any support to the USD, unlike what was expected.Â

Technically: the GBP/USD is still in a bullish movement, and settling above 1.2900 would support the case for more gains towards the psychological top at 1.3000, which will support the bullish correction power and pave the way towards more record tops for the pair.Â

On the bearish side: the nearest support areas for the pair are currently at 1.2840 and 1.2780, and any movement below the later would be a chance to buy the pair again.Â

On the economic data front: the economic agenda today shows that the pair will be awaiting an important announcement of US data in the form of durable goods orders and unemployment claims.Â