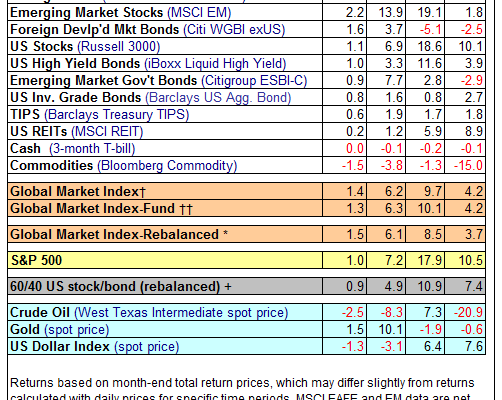

April was kind to global markets. Positive returns were widespread for the major asset classes last month, led by a strong gain for inflation-linked bonds in foreign markets. The only loser: broadly defined commodities, which dipped for a second month.

Leading the field higher in April: foreign-listed inflation-linked bonds. The Citi World Inflation-Linked Securities Ex-US Index posted a strong 4.0% total return in April (in unhedged US dollar terms). The gain marks the highest monthly advance for the benchmark in more than a year. Key drivers for the advance include signs of firmer inflation for the global economy and a weaker dollar. The US Dollar Index fell 1.3% in April, the second monthly decline in a row for the greenback.

A softer dollar and higher inflation tend to support commodity prices, but last month was an exception. The Bloomberg Commodity Index (BCI) slipped 1.5% in April, the second straight month of red ink. Year-to-date, BCI is down 3.8% — the only major asset class (other than cash) that’s nursing a year-to-date loss so far in 2017.

Meanwhile, the Global Market Index (GMI) — an unmanaged benchmark that holds all the major asset classes in market-value weights — posted another monthly advance in April. Last month’s 1.4% total return marks the fifth straight monthly increase, boosting the benchmark’s year-to-date gain to a healthy 6.2%.