The GBP was negatively affected by yesterday’s transactions despite a strong improvement in the British Manufacturing Sector. The GBP/USD retreated towards the support at 1.2865 before settling back at 1.2900 until reaching towards 1.2947 and settling again at 1900 at the time of writing. The pressure on the GBP came with the return of the concerns towards a hard Brexit as a result of the decision by the EU leaders regarding the extreme exit terms for the UK in the Brussels summit on Saturday. The summit increased Brexit fears as initially expected, as the smooth exit would lead to more separation calls, which is not acceptable by Germany and the EU as a whole, as that would mean the collapse of the EU and the Euro. The continued worries about any update regarding Brexit would pause the GBP advance which have made strong gains after the UK PM suddenly announced a snap elections to support the political stability in the Brexit stage.Â

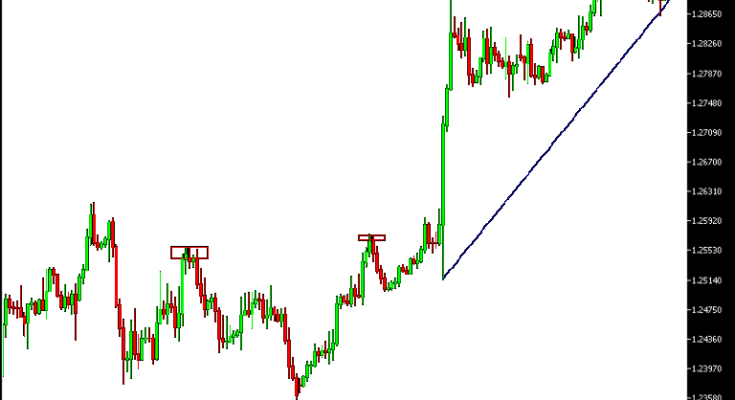

Technically: The GBP/USD is still in the upward trend, and settling above 1.2900 would support the move towards more gains, the nearest of which would be the psychological top at 1.3000, which is where the bullish strength will be established. On the bearish side, the nearest support areas are currently at 1.2830 and 1.2770, and a move below the latter would threaten the current bullish move of the pair.Â

On the economic data front: The economic agenda today shows that there will be an announcement of the Construction PMI from the UK. As for the US, we will have the ADP non-farming employment change report, the non-manufacturing ISM index, then the Federal Reserve’s interest rate and the monetary policy statement, amid strong expectations that the interest rate will remain as is at 1%.Â