Video length: 00:012:46

The May FOMC meeting should be nothing more than a placeholder until the next summary of economic projections (SEP) and Fed Chair Janet Yellen press conference in June. As it were, the Fed, like the ECB, BOE, and RBNZ, in an effort to become transparent, has become predictable: they will not make a major policy change (i.e., hike rates) without justification in hand and an opportunity for Chair Yellen to explain to markets why they made their decision.

With that said, after a slate of disappointing data to end Q1’17 culminating in a rather weak GDP report last Friday, market participants will be parsing the policy statement when it is released at 14 EDT/18 GMT for clues on how the FOMC feels it will be able to proceed going forward. Should the FOMC suggest that it will look through the data weakness, which appears to be the outcome given recent speeches, then markets may be forced to recalibrate their views on the interest rate hike path, which currently is far more dovish than what the Fed believes will happen.

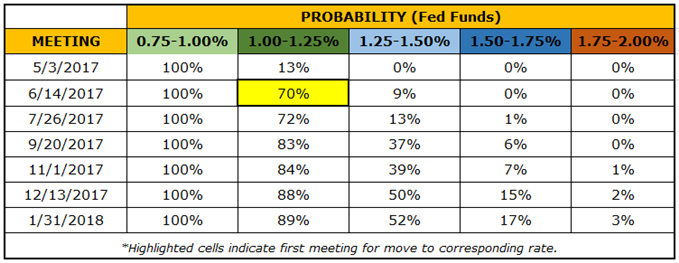

Ideally, the Federal Reserve, in its eyes, will hike rates twice more this year while announcing a change in their balance sheet policy by the end of the year. Given the calendar of press conferences and SEP releases, this means the Fed is looking to raise rates in June and September, before making the balance sheet winddown announcement in December. Currently, Fed funds futures are pricing in only one rate hike this year – in June – and have no other rate hikes priced in for the rest of 2017.

Table 1: Fed Rate Hike Expectations Through January 2018

Insofar as market pricing is more dovish than what the Fed has previously prescribed for its glide path of rates, a simple reaffirmation of its “three rate hikes in 2017” view may be seen as a vote of confidence for the US Dollar, which has been bogged down by diminished rate hike expectations. The Fed has previously said that it has not yet factored in any changes to fiscal policy to its forecasts, so the lack of progress by the Trump administration in healthcare reform, tax reform, or infrastructure spending should prove immaterial to the Fed’s outlook.