Emmanuel Macron has won the presidency of France, and markets can heave a sigh of relief. The key question for traders is what comes next.

As Bloomberg’s Cameron Crise notes, markets have cheered Macron’s victory not for who he is, but rather because of who he is not. That is a fairly slender thread on which to hang a case for a secular reversal in the euro.

Although the new president’s En Marche party should do well in the parliamentary elections next month, they seem unlikely to score an outright majority. Anyone hoping for a Thatcheresque revolution in France is likely to be disappointed.

It’s true that the European economy is doing well, and if the euro is to continue powering higher that will be the driver. Keep an eye on German bond yields; the Bobl yield is likely to threaten key resistance at -0.30% today. A break above could indeed provide a tailwind for the euro.

Ultimately, however, either the ECB or the Fed will need to change its tune to drive the euro substantially higher. While there is some hope that Mario Draghi will hint at a QE taper next month, it’s difficult to see him doing so unless there is a notable rise in core inflation.

With German and Italian elections further down the line, chasing the euro higher on a widely expected French result is probably not a good idea.

And across Wall Street, analysts see only a limited rally relief in euro and in French bonds as well as stocks. (via Bloomberg)

BNY Mellon

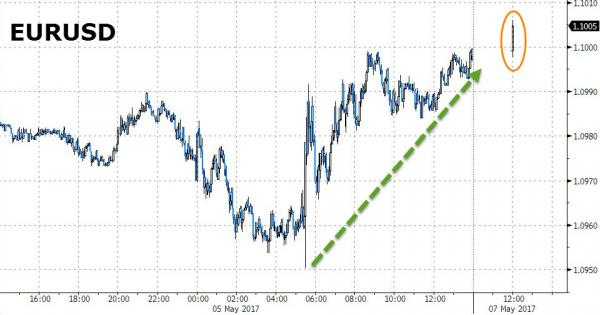

- “We would not be surprised were the EUR pushing toward USD 1.11 in early Asian trading,†strategist Neil Mellor said in client note

- The victory has been priced in more confidently than in round one; the market has had the reassurances offered by the remarkable accuracy of polling ahead of the first vote, and the June elections still lie in wait

Bank of America Merrill Lynch

- The outcome of the vote “should support the euro, although markets were already expecting Macron to win,†Athanasios Vamvakidis, head of G-10 currency strategy in London said in emailed comments

Credit Agricole

- “One shouldn’t expect fireworks later on. After all, there was a larger-than-90% probability for Macron making it, and polls ahead of the first round were quite accurate already,†strategist Manuel Oliveri said in emailed comments

- “A jump toward 1.1050 and slightly above is likely for euro, but a more sustained upside will depend on other factors such as further-stabilizing ECB monetary policy expectationsâ€