Written by Richard Turnill (BlackRockBlog.com)

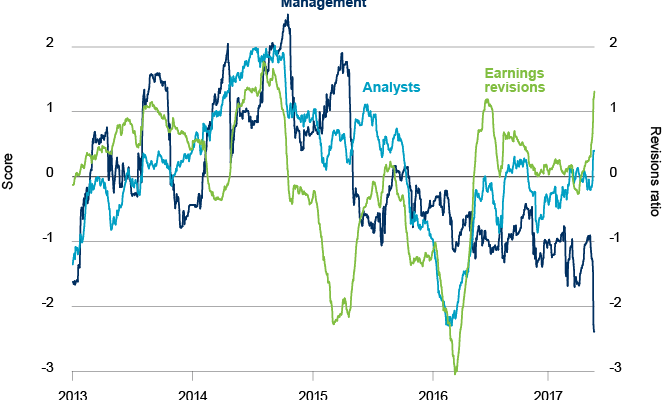

U.S. corporate earnings revisions and our gauge of analyst sentiment have rebounded strongly, as the chart below shows. We believe a catch up in management sentiment lies ahead as earnings growth persists. This supports our view of a sustained economic expansion.

Roughly 80% of S&P 500 companies that have reported first-quarter results have beaten analysts’ earnings-per-share (EPS) estimates.

- Energy is the largest contributor to first-quarter profits growth, but earnings and sales improvement is broad based.

- We see technology and financials as the strongest contributors to 2017 earnings growth.

There are other signs this is not just a story of easy year-on-year comparisons or a one-time rebound.

- Share buybacks and cost-cutting have helped propel bottom-line growth in recent years, but this quarter sales growth is tracking at the strongest level in more than five years.

The earnings recovery is even more impressive globally.

- European firms are tracking nearly 20% EPS growth from a year earlier,

- while companies in emerging markets (EM) are positioned to deliver the highest EPS growth since 2010.

Analysts have been revising up their earnings expectations for global equities in 2017—a departure from the pattern of downward revisions during first-quarter reporting over the last five years. The improvement in revenues—particularly from cyclical companies—and the strong global earnings picture support our belief that the global economy can sustain above-trend growth.

- We are encouraged by strong U.S. earnings but are keeping our neutral view of U.S. stocks.

- We see greater upside in European, Japanese and EM shares, and advocate geographic diversification in equity portfolios.

- Within the U.S., we prefer value shares and selected sectors, particularly technology and financials, that we see driving earnings growth.