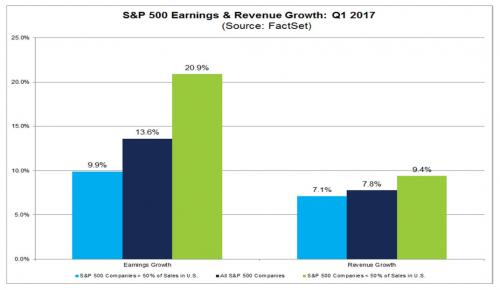

With 91% of companies in the S&P500 having reported earnings for the first quarter, Q1 2017 earnings season is almost fully in the history books, and is shaping up as the best quarter for annual earnings growth in six years. According to FactSet, the blended earnings growth rate for the S&P 500 in the first quarter is 13.6%, up from 13.5% last week, while revenue is poised to grow 7.8% Y/Y. The rise in profits was a function of both solid sales growth (+7.8%) and a 41 bp expansion in margins to 9.4%.

Additionally, 75% of S&P 500 companies have beat the mean EPS estimate and 64% of S&P 500 companies have beat the mean sales estimate.

If 13.6% is the final growth rate for the quarter, it will mark the highest (year-over-year) earnings growth for the index since Q3 2011 (16.7%).

The first quarter will also mark the first time the index has seen year-over-year growth in earnings for three consecutive quarters since Q3 2014 through Q1 2015. Ten sectors are reporting or have reported year-over-year growth in earnings, led by the Energy, Financials, Materials, and Information Technology sectors. The only sector that has reported a year-over-year decline in earnings is the Telecom Services sector.

On the top-line, the blended sales growth rate for Q1 2017 is 7.8%. Ten sectors are reporting or have reported year-over-year growth in revenues, led by the Energy sector. The only sector that has reported a year-over-year decline in revenues is the Telecom Services sector.

The biggest driver to Q1 Y/Y earnings was the energy sector, which was crushed last year as a result of the collapse in energy prices. In fact, as Factset points out, a growth rate was not calculated for the Energy sector for Q1 because the sector reported a loss in the year-ago quarter. On a dollar-level basis, the Energy sector reported earnings of $8.5 billion in Q1 2017, compared to a loss of -1.5 billion in Q1 2016. Due to this $10.0 billion year-over-year increase in earnings, the Energy sector was the largest contributor to earnings growth for the S&P 500 as a whole. If this sector is excluded, the blended earnings growth rate for the remaining ten sectors would fall to 9.4% from 13.6%; even that number would still rank as the highest in nearly six years.