For investors seeking yield, the real estate industry is a great place to look.

Intuitively, this is not surprising. Real estate owners collect predictable income from their tenants. Thus, the real estate business is qualitatively geared for business owners that want to collect periodic income.

This characteristic extends to the security level. One of the best ways for retail investors to gain exposure to the real estate industry is through real estate investment trusts – or REITs, for short. REITs are required by law to pass the majority of their income to shareholders as dividends.

STAG Industrial (STAG) is one example of a REIT that looks to be a very attractive investment right now. The company’s current dividend yield of 5.3% is nearly 3x as high as the average yield in the S&P 500. You can see the comprehensive list of all established 5%+ yield stocks here.

Further, STAG Industrial pays monthly dividends (rather than quarterly). This is highly beneficial for retirees and other investors who rely on their dividend income to cover life’s expenses.

Because of the trust’s high yield and monthly dividend payments, STAG Industrial has the potential to be a great investment for income-oriented investors.

This article will analyze the investment prospects of STAG Industrial in detail.

Business Overview

STAG Industrial is a REIT that specializes in industrial commercial real estate. The trust became publicly-traded in 2011 after spinning off from its predecessor, STAG Capital Partners (formed in 2004).

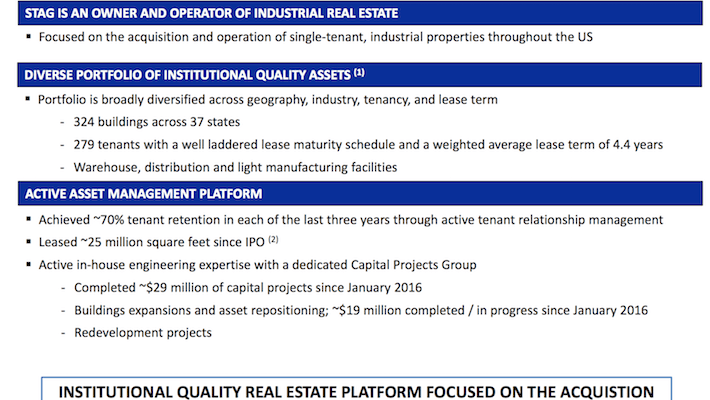

Since the IPO, STAG Industrial has grown substantially – from 105 buildings initially to its current asset base of 324 buildings in 37 states rented to 279 tenants.

More details about STAG Industrial’s current business model can be seen below.

Source:Â STAG Industrial Investor Presentation, slide 2

The trust specializes in owning and operating single-tenant industrial real estate properties. Most REITs view single-tenant properties as highly risky. This creates mispriced assets, which STAG can then add to their portfolio at attractive valuations.

Most REITs view single-tenant properties as highly risky – and this is true, to an extent – but this creates mispriced assets which STAG can then add to their portfolio at attractive valuations.

Source:Â STAG Industrial Investor Presentation, slide 3

Since single-tenant properties are riskier than multi-tenant properties, investors should be rightly concerned about the impact of vacancies on STAG’s bottom line.

So how does STAG Industrial mitigate this risk?