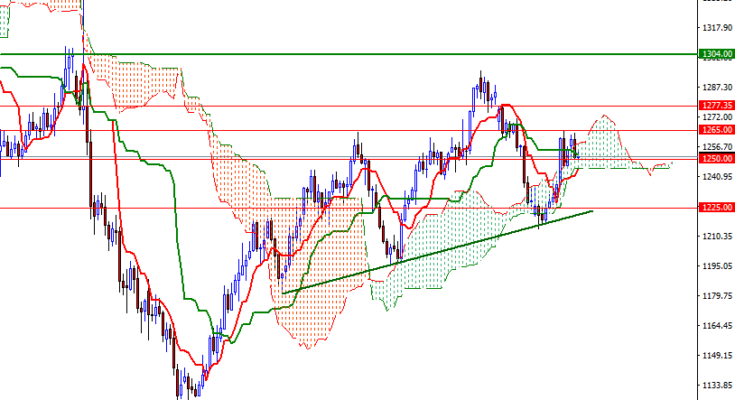

Gold prices fell $9.20 an ounce yesterday, erasing the gains made in the previous session, as the dollar strengthened and traders locked in profits ahead of the release of the minutes from the Federal Reserve’s May 2-3 policy meeting. Philadelphia Fed President Patrick Harker said “A slow first quarter isn’t something to ignore entirely, but weak first quarters have been a feature of the economy for the past several years. It’s essentially the norm now… based on the strong economic outlook, I continue to see three rate hikes for 2017 as appropriate.” The market challenged the resistance in the $1265/1 area again but prices were not able to break through. As a result, XAU/USD retreated to the support in the $1252/0 zone, which looks in danger at the moment.

The market is currently within the trading range of the past four sessions (1265-1245) and trying to stay above the 1250 level. The bottom of the daily Ichimoku cloud and the Tenkan-sen (nine-period moving average, red line) are confluent and should continue to act as support. That said, the bears will need to eliminate this support to set sail for 1241.70-1239. A break down below there implies that 1236.50-1235.30 will be the nest port of call.

XAU/USD is residing below the clouds on the H1 and the M30 charts, so the bulls have to lift prices above 1257.50 to take the reins and gather momentum for a test of 1261. Beyond there, the 1265 level (the top of the weekly cloud) stands out as an obvious key resistance. Closing above 1265 on a daily basis could provide buyers the extra fuel they needed to tackle the next resistance in the 1271.50-1269 area.