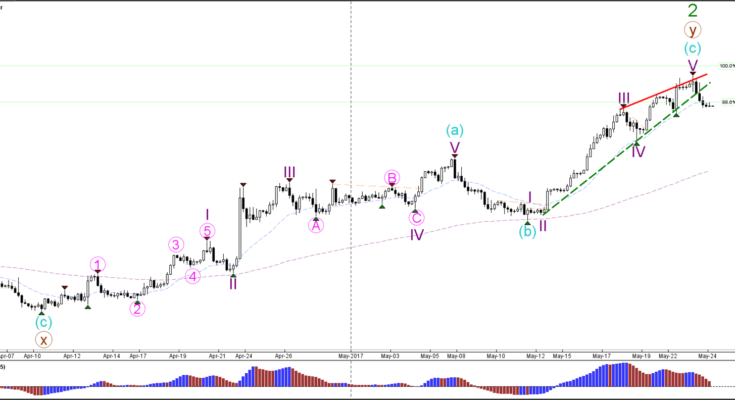

EUR/USD

4 hour

The EUR/USD failed to break above the 1.1250-1.13 resistance zone and showed a bearish reversal or correction. Price also broke below the rising wedge chart pattern which is indicated by the broken support (dotted green) and resistance (red).

1 hour

The EUR/USD seems to have completed the 5th waves (pink/purple) and price could either be retracing within the uptrend or starting a new downtrend. The wave count is showing a bearish 123 (purple) wave pattern, which would become more likely if price manages to break the bear flag (blue lines) and fall towards 1.11-1.1130. Otherwise the bearish price action runs the risk of being a correction which becomes likely if price manages to push above 1.1250.

USD/JPY

4 hour

The USD/JPY broke the resistance trend line (dotted orange) and is approaching the -27.2% Fibonacci target. A bearish bounce could indicate a continuation of the downtrend but a break above 112-112.50 would indicate that the wave C (brown) of wave B (blue) is completed at the recent low.

1 hour

The USD/JPY is building a potential wave 4 (orange) correction and a wave 5 (orange) continuation before completing wave C (brown). However if price breaks above the 61.8% Fibonacci level of wave 4 (orange), then a different wave structure seems likely.

GBP/USD

4 hour

The GBP/USD has been unable to break above resistance (red/orange) levels which could mean that the Cable is still in a wave 1-2 (blue). A break above the orange trend line indicates the invalidation of wave 2 and the potential for an uptrend continuation whereas but a break below the channel support (green/blue) could see a reversal take place.

1 hour

The GBP/USD is moving sideways in a correction which could be an ABC (orange) within wave 2 (blue).

Â