Today was a good example of the physics principle, “an object in motion, stays in motion…â€

The markets follow this concept in many ways – momentum, trend lines, moving averages, phases, etc.

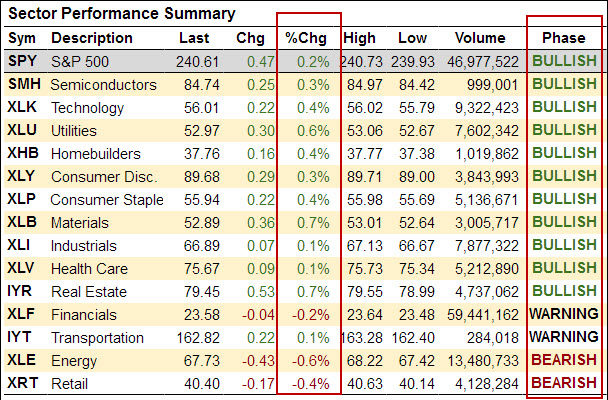

Today 13 out of the 14 sectors tracked in our sector summary table traveled in the same direction as their phase. The one sector (IYT, Transportation) that did the opposite only moved .1%.

This is a good example of why we pay so much attention to Market Phases. They work well.

Today, the markets waited patiently for the FOMC minutes, and then when there were not any surprises they drifted higher. Not surprisingly, the QQQ with the strongest market phase had a stronger ‘drift up’ than the weaker IWM.

Obviously markets can’t go in the same direction forever, but as we head into the 3 day weekend it’s hard to expect anything different than what we’ve seen so far this week – quiet trends and consolidations.

S&P 500 (SPY) Fifth up day in a row and a quiet new all-time high. First support is now 240 then around 237.70, and 236.50 before you get to the weekly low of 235.40 If that breaks watch out below with support at 233.50 and then 225.

Russell 2000 (IWM)Â Consolidation day with a high at big resistance level of 138. Look for support about 136.80-137, but if it breaks below 136.35 it may be headed back down. A close above 138 would put things in a positive perspective

Dow (DIA) Marginally higher and stopped at 210 which is a big resistance level. 206.50 may offer support. 205.85 is the weekly low and if that breaks then it should find support around 204. If it breaks 204 the next support level is 194 on monthly charts

Nasdaq (QQQ)Â New highs.. Important support at 135.80 and if broken look for next support at 133.70

KRE (Regional Banks) Inside day, consolidation. There’s a lot of resistance at 54-55. The big support to hold is 51.50. Big support at 46.50.

SMH (Semiconductors) A quiet new high. May find support at 84, but needs to hold 81.44. If it can’t, next support at 79.60.