The inflation numbers just came out and the results where as follows:

– CPI (YoY) Jun: 0.50% (est 0.40%; prev 0.30%)

– CPI Core (YoY) Jun: 1.40% (est 1.30%; prev 1.20%)

– RPI (YoY) Jun: 1.60% (est 1.50%; prev 1.40%)

– PPI Input NSA (MoM) Jun: 1.80% (est 1.30%; rev prev 2.20%)

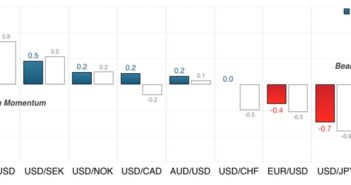

These are great numbers and the pound should have rallied against all majors but it didn’t. In fact, 25 minutes after the release, it´s down 0.43% against the US Dollar and 0.52% against the Japanese Yen. Why?

Simple, most of this inflation data was collected pre Brexit and hasn’t taken into account the massive drop that came from the decision to leave the European Union.

The pound depreciated more than 10% during Brexit and at the time we wrote this article its down 0.90% against the US Dollar this month. Momentum in the pound remains extremely bearish.

With the next round of inflation data coming out considering this drop in the pound, more easing and a rate cut expected from the Bank of England, we remain bearish regardless this report.

There are off course some serious technical levels that we need to break for a continuation to the downside:

– Previous monthly low at 1.3119

– Weekly pivot 1.3170

– Head and Shoulders neckline: 1.3150

Below these levels we are looking at the current monthly low at 1.2780 and previous weekly low at 1.2848 to act as support.

[Orlando Gutierrez] of [www.snipethetrade.com]