Here we go again.

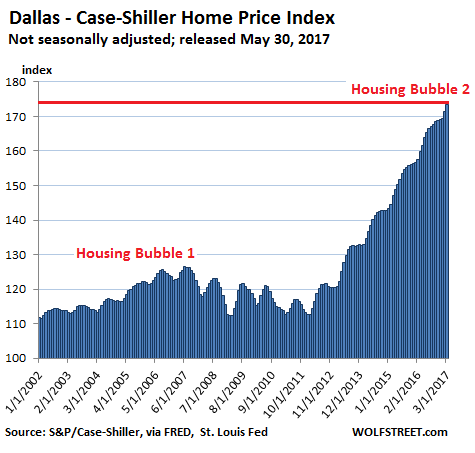

As you can see from Naked Capitalism’s Case-Shiller Chart, those who forget the mistakes of the past are doomed to repeat them and we just passed the last “out of control” housing peak. As the Fed’s Neel Kashkari said about housing prices:

“It is really hard to spot bubbles with any confidence before they burst.  Everyone can recognize a bubble after it bursts, and then many people convince themselves that they saw it on the way up.â€

As noted by Scofield, it’s really not hard at all to see when you are in a bubble, the hard part is predicting when they will finally burst. Housing prices jumped 7.7% from last year, far outpacing the growth in household incomes, thus making homes more and more unaffordable for the average buyer. However, the people buying homes are above average – generally in the Top 10% of Income Earnings which, in Donald Trump’s America, makes them better people than the other 90% of you and more deserving of a good home.

After all, what else matters in life but how much money you make, right? Of course right – you voted for it! Â

Some regions are more bubbly than others, mostly in Texas and out west (Seattle, Denver, San Francisco) with massive gains since the last bubble burst. Yesterday’s read on the Beige Book shows an economy that does not support this kind of housing recovery and just last night, San Francisco Fed President John Williams said the Fed is still on path for 2 more hikes in 2017 with a goal of 3% by 2019.

That’s up 2.5% from where we are now and do you know what happens to mortgage payments when they go from the current 3.5% average to 6%? Again, we only have to remember what happened in 2007/8 but, for example, a person buying a $250,000 house with a $200,000 mortgage pays $898/month at 3.5% but will pay $1,199/month at 6%. That’s $300/month more, which is 33% and people don’t buy houses, they buy mortgages so it’s going to be up to the homeowners to bring the price of the home down low enough for people to be able to afford the mortgage. Â