Investing is all psychological.Â

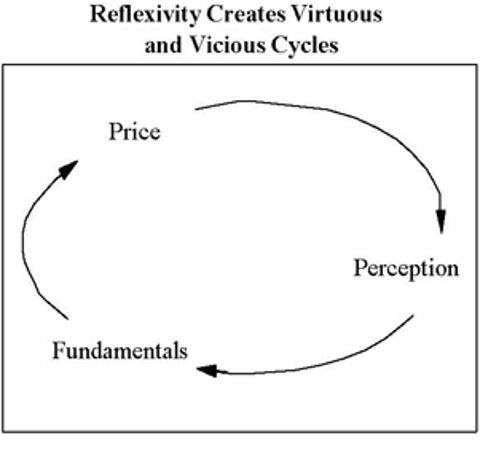

I learned from George Soros how important his Theory of Reflexivity is. The crowd’s prevailing perception is what moves prices up or down, which further reinforce fundamentals, then proving the perception correct.

People will believe what they want to see. If the crowd is expecting a bear market and catastrophe, they will sell everything. And if they are expecting a bull market with bailouts protecting them, they will buy no matter how high the price.

Financial markets, far from accurately reflecting all the available knowledge, always provide a distorted view of reality. This is the principle of fallibility. The degree of distortion may vary from time to time. Sometimes it’s quite insignificant, at other times it is quite pronounced.

Every bubble has two components: an underlying trend that prevails in reality and a misconception relating to that trend. When a positive feedback develops between the trend and the misconception, a boom-bust process is set in motion. The process is liable to be tested by negative feedback along the way, and if it is strong enough to survive these tests, both the trend and the misconception will be reinforced. – George Soros

Since 2008, investors witnessed the extraordinary lengths that the central banks and governments went to, through zero-to-negative interest rates and straight-up printing money via quantitative easing.Â

They did all this to maintain confidence in the monetary system.Â

Because without confidence, investors will just sit idle and hoard cash and probably gold. This is what happened during the 1930s Great Depression. The persistent fear is what made it the decade-long GREAT depression.Â

Ben Bernanke, the former Federal Reserve Chairman, knew this. After-all, he was a self-proclaimed expert on the Great Depression.Â

So he did whatever was necessary to persuade investors that confidence was stable. So that consumers would keep borrowing and buying.Â