After the weaker than expected nonfarm payrolls in May – 138,000 new jobs were created after a revised lower 174,000 number was posted in April – Goldman Saks Chief US Equity Strategist David Kostin is more convinced of a rate hike in June. But perhaps most meaningful is what happens in September as it relates to the US Federal Reserve balance sheet. The predicted Fed move to announce plans for balance sheet reduction has potential to influence a popular mutual fund holding – a stock sector holding that hedge funds have since generally dismissed.

(Click on image to enlarge)

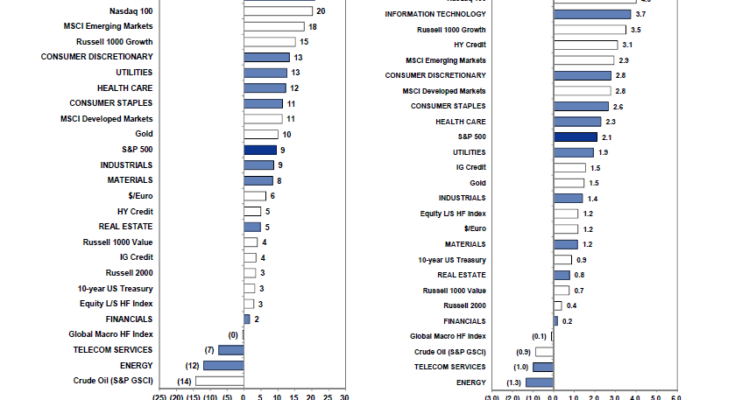

How do markets react when interest rates are rising and the Fed is unwinding its balance sheet?

With a $4.6 trillion balance sheet, the talk among Fed watchers that sometimes stays off the official radar wonders how the balance sheet will be managed? Did central bankers have an investment exit strategy and calculate the different risk management probability paths when they started down the artificial stimulus path? If central bankers decide to unwind their historic balance sheet, the meaningful question is what might result from the correlated impact on supply hitting markets as interest rates are rising?

In a June 2 US Weekly Kickstart publication, Kostin and his team make a one sentence prediction that has potential to impact financials to a significant degree. When forecasting that the US Federal Reserve might unwind their wound tight balance sheet, starting with an announcement in September, this is answering the whisper question.

In the past, fund managers have been watching the unwinding of dependent stimulus and modeling various probability paths. In part, this talk was evident in 2015 when certain hedge funds were discussing probability paths relative to a delicate unwind and got neutral the market before this occurred.

This is a surgery where success is not heralded in news headlines.

Chair Janet Yellen is successful at eliminating the dependency of stimulus and unwinding the unprecedented Fed balance sheet, that success will be measured by the lack of news about it. The economy will keep on running without a hitch and Yellen, the first female Fed chair, will likely not receive much acclaim outside of knowing professionals. In particular, certain analysts will keep an eye on the reaction along the yield curve as both interest rates are rising and a potential source of supply – the Fed balance sheet unwind – hits markets.