Economic growth has returned. Production and employment slope upwards in most countries of the Western world. However, economic recovery has been accompanied and fueled by an unprecedented expansionary monetary policy.

Bond prices have been inflated to an extraordinary degree.

Interest rates have been pushed down to extremely low levels, and central banks have de facto provided financial markets with a safety net: Investors can rest assured that central banks are willing and prepared to fend off another crisis – ‘whatever it takes.’

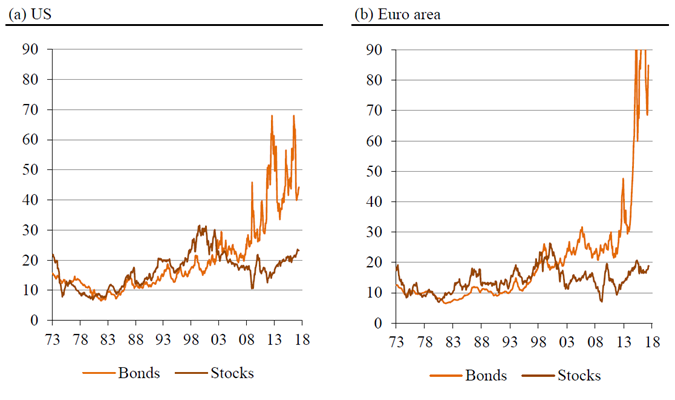

As a result, various financial asset prices have been pulled up to elevated valuation levels. In particular bond prices have been inflated to an extraordinary degree. For instance, the price-earnings-ratio for the US 10-year Treasury yield stands around 44, while the equivalent for the Eurozone trades at 85. In other words, the investor has to wait 44 years (and 85 years, respectively) to recover the bonds’ purchasing price through coupon payments.

At the same time, valuation levels of the stock markets have been edging up as well. This can in part be attributed to the extraordinarily low interest rates: Future corporate earnings are discounted by low yields, translating into higher stock prices. Furthermore, the ongoing economic recovery makes investors more confident with regards to the growth of future corporate earnings. That said, any investor should consider it important to learn more about the nature of the current recovery.

Sooner or later the monetary illusion must evaporate.

If and when central banks, in cooperation with commercial banks, increase the outstanding quantity of money through credit expansion – namely credit that is not backed up by “real savings” – an artificial upswing (“boom”) is triggered. Artificial credit expansion lowers market interest rates (to below the level that would prevail had there been no credit expansion ‘out of thin air’). Investment and consumption expenditures go up; jobs are created. But it cannot go on forever.