|

Currency |

Last |

High |

Low |

Daily Change (pip) |

Daily Range (pip) |

|

GBP/USD |

1.2767 |

1.2795 |

1.2691 |

16 |

104 |

GBP/USD pares the decline following the Federal Open Market Committee (FOMC) meeting as the Bank of England (BoE) votes 5 to 3 to keep the benchmark interest rate at the record-low of 0.25%.

The growing dissent within the Monetary Policy Committee (MPC) may continue to limit the downside risk for the British Pound as Michael Saunders and Ian McCafferty now push for a rate-hike, but the rift may fail to boost interest-rate expectations as Kristen Forbes departs from the BoE at the end of the month. With that said, market participants may pay increased attention to fresh remarks from Governor Mark Carney as the central bank head is scheduled to speak at the Mansion House Banks and Merchants dinner, and the British Pound remains at risk of giving back the relief rally from earlier this year as the majority of the BoE remains in no rush to normalize monetary policy.

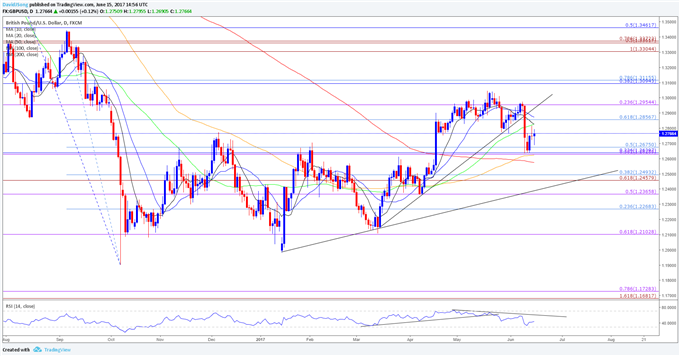

GBP/USD Daily

Â

Chart – Created Using Trading View

- Lack of momentum to break/close below the Fibonacci overlap around 1.2630 (38.2% expansion) to 1.2680 (50% retracement) may generate range-bound conditions for GBP/USD as the former-resistance zone offers support; first topside hurdle comes in around 1.2860 (61.8% retracement), which sits just above the 50-Day SMA (1.2826), followed by 1.2950 (23.6% expansion).

- However, the broader outlook for GBP/USD is no longer constructive as the pair fails to preserve the upward trend from March, with the Relative Strength Index (RSI) highlighting a similar dynamic; may see the pound-dollar exchange rate continue to give back the relief rally from earlier this year as the momentum indicator starts to carve a bearish formation, with a move below the 100-Day SMA (1.2624) & 200-Day SMA (1.2574) opening up the next downside region of interest around 1.2460 (61.8% expansion) to 1.2490 (38.2% retracement).