Urstadt Biddle Properties (UBA)(UBP) is a high-quality REIT that has employed a successful strategy. It has targeted growth in a high-income, densely populated area of New York, with limited supply.

This has given Urstadt Biddle a durable competitive advantage, which has allowed the company to pay dividends for several decades.

The company has paid uninterrupted dividends for 46 years in a row.

It has also increased its dividend payout for 23 years in a row. This qualifies Urstadt Biddle as a Dividend Achiever, a group of 264 stocks with 10+ years of consecutive dividend increases.

In addition to its dividend growth, the stock offers a high yield above 5%. It is one of 416 stocks with a 5%+ dividend yield.

This article will discuss how Urstadt Biddle’s successful real estate investment strategy makes it a strong high-yield dividend stock.

Business Overview

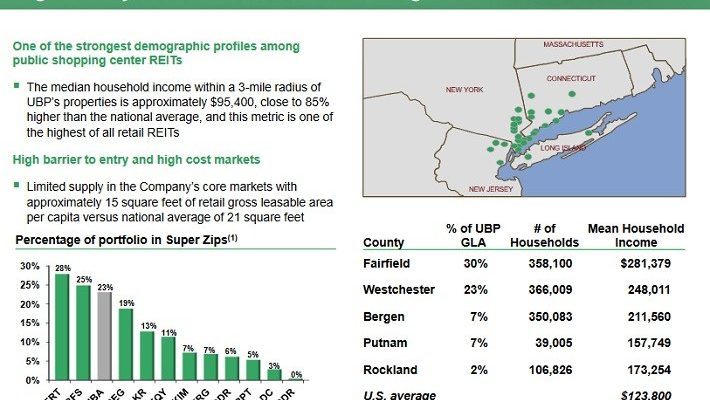

Urstadt Biddle owns, operates, and redevelops retail shopping centers, which are mostly located in the New York Metro area. It focuses on cities within commuting distance to New York City.

The company believes its properties provide several competitive advantages, including:

- Dense populations

- High local incomes

- High barriers to entry

This strategy has worked well. According to the company, the median household income within a 3-mile radius of UBP’s properties is approximately $95,400, which is 85% higher than the national average.

Â

Source:Â NAREIT June 2017 Presentation, page 4

Urstadt Biddle has a strong property portfolio.

As of May 15th, 2017, there were 80 properties in the portfolio, 94% of which was leased. Annual base rent is approximately $22.28 per square foot.

The portfolio is sufficiently diversified across the following industry groups:

- Supermarket/Wholesale clubs/Drugstores (82% of square footage)

- Neighborhood convenience retail (8% of square footage)

- Regional centers adjacent to regional malls (8% of square footage)

- Office buildings/Bank branches (2% of square footage)