S&P futures rose 0.3% in subdued trading with Dow Jones futures once again in record territory as European stocks jump 0.6% following Sunday’s landslide victory for Macron’s party in the French parliamentary elections and as Brexit negotiations are set to officially roll out on Monday.

In the latest terrorist incident in London overnight, a man drove a van into pedestrians as people left their mosque following prayers, with UK PM May stating that UK police have confirmed the incident is being treated as a potential terrorist attack. Later updates stated that the one fatality could have been dead before being run-over while 2 others are considered to be seriously injured.

Asian equities opened on the front foot led by a rebound in tech stocks while benchmark sovereign yields and FX remains little changed; kiwi outperforms following solid domestic data; yen slightly lower. Australian bonds modestly softer, T-note futures unchanged with the AUDUSD sliding, but then recouping all losses after Moody’s cut the long-term ratings of Australia’s four major banks, ANZ, CBA, NAB and Westpac, to Aa3 from Aa2.

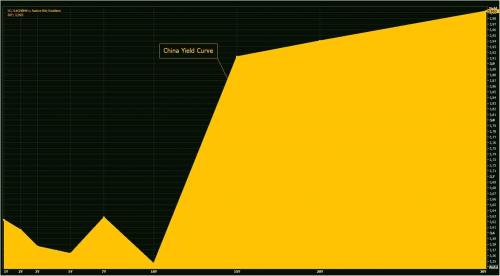

In China, the PBOC kept daily CNY fixing little changed and conducted net 110 billion yuan of open market operations, injecting liquidity for a fifth straight day and boosting cash injections in the past two days to the most since January. 7-day repo rate fell 23 basis points. Boosted by the sudden bout of PBOC liquidity generosity, Chinese 10-year sovereign bond yield declined 8 basis points, the most since Dec. 29, to 3.50%, sending the yield to the lowest since early May, however the 1-year yield dropped just 4 basis points to 3.58%, sending the Chinese 1s10s yield curve even more inverted.

Chinese and Hong Kong stocks jumped 0.7% and 1.2% ahead of a decision by index provider MSCI on Tuesday, expected to see it add mainland-listed Chinese stocks to its top share benchmarks for the first time. Chinese data had also helped, with Reuters noting that liquidity conditions appear to have eased and home prices up 10.4% in May from a year ago, although slowing from April’s 10.7% gain.

“Generally, the environment still remains fairly positive for risk appetite,” said Khoon Goh, head of Asia research at Australia and New Zealand Banking Group in Singapore.

In Europe, stocks headed for their biggest rise in seven weeks on Monday as investors snapped up slammed retail, tech and automaker stocks and France’s shares and bonds cheered an absolute parliamentary majority for President Emmanuel Macron as the Stoxx Europe 600 gained for a second day. Europe’s retailers also clawed back some ground having been clobbered along with U.S. peers like Wal-Mart and Target on Friday by Amazon’s $13.7 billion deal to buy upscale grocer Whole Foods Market. The CAC 40 jumped after President Emmanuel Macron’s government claimed a historic majority in France’s legislature, although marred by a record low turnout, which perhaps is why the German-French spread moved just fractionally on Monday.

“We expect the Macron reforms to transform France like the Thatcher reforms had cured the erstwhile sick man of Europe, the United Kingdom, some 35 years ago,” said Berenberg European economist Holger Schmieding. “And like the ‘Agenda 2010’ reforms had turned Germany from one of the weakest into one of the strongest economies in Europe almost 15 years ago.”

As Bloomberg notes, investors are once again in risk-on mode as the week begins, even as a cloud of uncertainty swirls around both U.K. leadership and the outlook for Brexit negotiations.

“Risk assets around the world are rallying again as the ‘carry party’ resumes,†Societe Generale SA strategist Kit Juckes wrote in a client note. Fed Chair Janet Yellen “did nothing to persuade the market†to take its hawkish outlook for the path of interest rates seriously, he said.

Sterling rose with cable just above $1.28 ahead of the formal start of negotiations on Britain’s planned exit from the European Union, expected to generate plenty of headlines for the currency in the weeks ahead. Brexit Secretary David Davis starts negotiations in Brussels on Monday, which will be followed by a Brussels summit on Thursday and Friday where Prime Minister Theresa May will meet – but not negotiate with – fellow European Union leaders.

Davis’s agreement to Monday’s agenda led some EU officials to believe that May’s government may at last be coming around to Brussels’ view of how negotiations should be run. May’s own political survival is in doubt after she lost her parliamentary majority in an election this month.

On the topic of Brexit negotiations, which officially kick off today, SocGen’s Juckes said “we expect nothing because the UK position is as clear as mud’ beyond growing signs that the UK wants free trade without being part of the customs union or conceding grounds on borer controls. Sterling’s probably range-bound. Any rally triggered by ‘soft Brexit’ hopes is probably temporary.”

With no macro data on today’s calendar, the market will await comments by New York Fed President William Dudley when he speaks at a business roundtable in New York state.

“In the wake of Friday’s weak U.S. data, Dudley could provide insight into whether the Fed is still poised to continue normalizing monetary policy,” said Masafumi Yamamoto, chief forex strategist at Mizuho Securities in Tokyo.

The euro was steady as talks begin on the U.K.’s split from the European Union, while the British pound strengthened after dropping early in the session.

In commodities, oil futures lingered near six-week lows over concerns about a supply glut amid faltering demand. WTI slipped 0.35% to $44.58 a barrel, while Brent dropped 0.3% to $47.21. Iron ore rallied 2.8% after snapping a three-week losing streak.Gold touched a 3-1/2-week low earlier in the session and was trading down slightly at $1,250 an ounce.

In rates, two-year gilts underperform the rest of the curve after the Sunday Times reported the BOE is considering ending its term funding scheme; euro-area periphery bonds outperform core peers. The yield on 10-year Treasuries was little changed at 2.15 percent.