In an eventful overnight session which saw a historic transition in Saudi Arabia, an unexpected Republican victory in the Georgia Special Election, China’s inclusion in the MSCI EM index and Travis Kalanick’s resignation, S&P futures continued to fall, alongside stock markets in Asia and Europe, while oil prices extended their drop despite a larger than expected draw reported by API on Tuesday. The USDJPY continued its recent slide, dropping just shy of 111, while GBPUSD tumbled as low as 1.2589, the lowest since May announced the UK election, only to reverse and recover all gains ahead of the Queen’s speech on Wednesday.

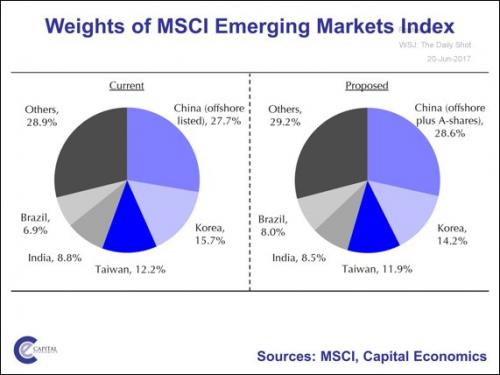

Despite the much hyped inclusion of 222 mainland Chinese shares in the MSCI EM index starting May 2018, which will by only 0.73% to include Chinese A-shares, the Shanghai composite closed a modest 0.5% higher, as the initial euphoria fizzled following calculations that buying pressure from the MSCI shift would be muted. MSCI estimated the change, due around the middle of next year, would drive inflows of between $17 billion and $18 billion. China’s market cap is roughly $7 trillion.Â

The index provider also set out a laundry list of liberalization requirements before it would consider further expansion. “We suspect that it will be a long time before this happens,” wrote analysts at Capital Economics in a note. While China’s weighting in the MSCI Emerging Markets Index may ultimately rise to 40 percent or so, this rise is likely to be slow,” they added. “The upshot is that any initial boost to equities is likely to be small.”

“Inclusion is unlikely to result in a significant shift in the underlying flow picture,” Goldman Sachs economists led by MK Tang write in note. “While short-term sentiment could be favorable, over the longer term we continue to expect the CNY to move in a managed path, gravitating gradually towards a weaker level against the USD due to fundamental forces.”

More notably perhaps, the offshore yuan dropped, shrugging off MSCI’s decision to include mainland shares in its benchmark stock indexes while China’s Ten-year sovereign bonds fall, with the yield rising the most in 6 weeks after the PBOC drained CNY 40bn in liquidity, even as S&P said it sees a “real possibility” of a China downgrade, for one simple reason: China continues to drown in debt.

European shares fell for a second day as crude continued to edge lower. Haven demand spurred the yen and gold, which was poised to advance after five days of losses. For once oil’s woes had little impact in Saudi Arabia, where a palace reshuffle and good news from MSCI Inc. boosted equities. Shanghai stocks also advanced after the index provider added China’s domestic shares to its emerging-markets gauge.

Another key overnight development, was the Saudi Royal reshuffle in which King Salman stripped the current crown prince, his nephew Mohammed bin Nayer, of his post, and replaced him with his son, Mohammed bin Salman.While speculation remains on what was the cause for the historic shakeup, with the ongoing collapse in the price of oil and resulting sharp saudi deficits cited as the most likely one, the local market took it in stride, with the Saudi Tadawul All-Share index rallying 3.3% after the news.

Back to markets, Australia’s S&P/ASX 200 Index slumped 1.6%, erasing its gain for the year, as energy shares tumbled. BHP Billiton and Rio Tinto both slid at least 2.9 percent. While the SHCOMP eeked out modest gains, Hong Kong’s Hang Seng Index fell 0.6% perhaps due to rebalancing.

European shares fell for a second day as crude extended its drop further into a bear market. Safe haven demand spurred the yen and gold, which was poised to advance after five days of losses. The ongoing weakness in crude and other commodities threatens to crush arguments from US central bankers that weak inflation rates will be transitory, adding to concerns of a Fed policy error that could unintentionally crimp the global economic recovery, according to Bloomberg. The Stoxx Europe 600 lost 0.7% with bank stocks leading the way.

All eyes remained on oil, where signs of a growing glut of supply and rising Libyan output sent Brent crude futures skidding back to $45.50 as European trading gathered momentum. The slide in energy costs boosted bond prices and flattened yield curves as investors priced in lower inflation for longer, while safe-haven flows underpinned the Japanese yen.

“Brent now the lowest since mid-November: remember that whole reflation thing? No, neither does the market,” Rabobank analysts told clients in a reference to Brent crude futures, which have slid almost 10 percent this month, and over 20% since the recent highs. Oil had shed 2% on Tuesday, taking U.S. crude futures into a bear market, a red flag to investors who follow technical trends.

The moves in rates were just as dramatic, with the spread between yields on U.S. five-year notes and 30-year bonds shrank to the smallest since 2007 as investors wagered the Federal Reserve might have to delay further rate hikes. Thirty-year German debt yields bonds also tumbled back toward two-month lows, adding to a more than 20-basis-point drop over the past month and ahead of what will now be a closely watched sale of 30-year debt in Berlin later.

“The plunge in oil prices ignited a bull flattening on the German and U.S. curve,” analysts at UniCredit said in a note adding that it suggested “reflation trades are finally deflated.”

The recent setback for crude and commodity prices as well some equity markets is partly over doubts of Trump’s promised multi-trillion dollar stimulus program, which had raised hopes of boosted inflation and growth, and has been a huge disappointment instead.