Video length: 00:06:51

The US Dollar has rallied each of the past two days, thanks in part to Fed speakers flooding the newswires which have been otherwise quiet due to a barren US economic calendar. Yet today, with no Fed officials set to speak, the US Dollar may pause without its prime source of support: hawkish Fedspeak.

In the space filled otherwise by meaningful US economic data, the Fed speakers have had and will continue to have a chance for their remarks to be amplified. Considering the Fed’s position last week was considered hawkish relative to expectations, another two days of Fed officials defending their outlook could help the US Dollar stabilize further.

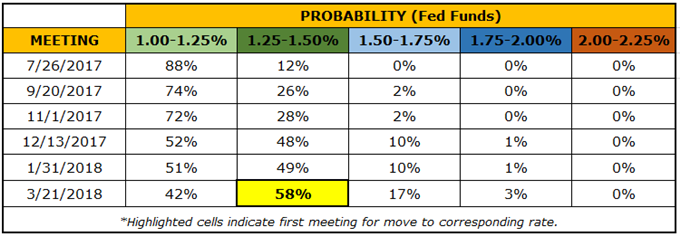

Table 1: Fed Rate Hike Expectations Through March 2018

Market expectations are currently in complete disagreement with the FOMC over the pace of rate hikes. While the FOMC suggests a plan of a third rate hike this year as well as the beginning of balance sheet normalization, interest rate markets (per Fed funds futures) project only a 48% chance of a rate hike by December 2017, and are pricing in March 2018 as the most likely period for the next rate hike.

Amid the pause on the Fed speaker circuit this week, the Reserve Bank of New Zealand’s rate decision later today (17 EDT/21 GMT) is far and away the most important event on the calendar. Since the RBNZ met last, economic data and financial markets having shifted meaningfully. While there hasn’t been an inflation release in the interim period for the RBNZ to pass judgment on, the NZD/USD exchange rate has rebounded sharply, up around +6% since the May 11 meeting.

In context of the what was said at the last meeting, the Kiwi strength will not be taken kindly. Recall, “The trade-weighted exchange rate has fallen by around 5 percent since February, partly in response to global developments and reduced interest rate differentials. This is encouraging and, if sustained, will help to rebalance the growth outlook towards the tradables sector.â€