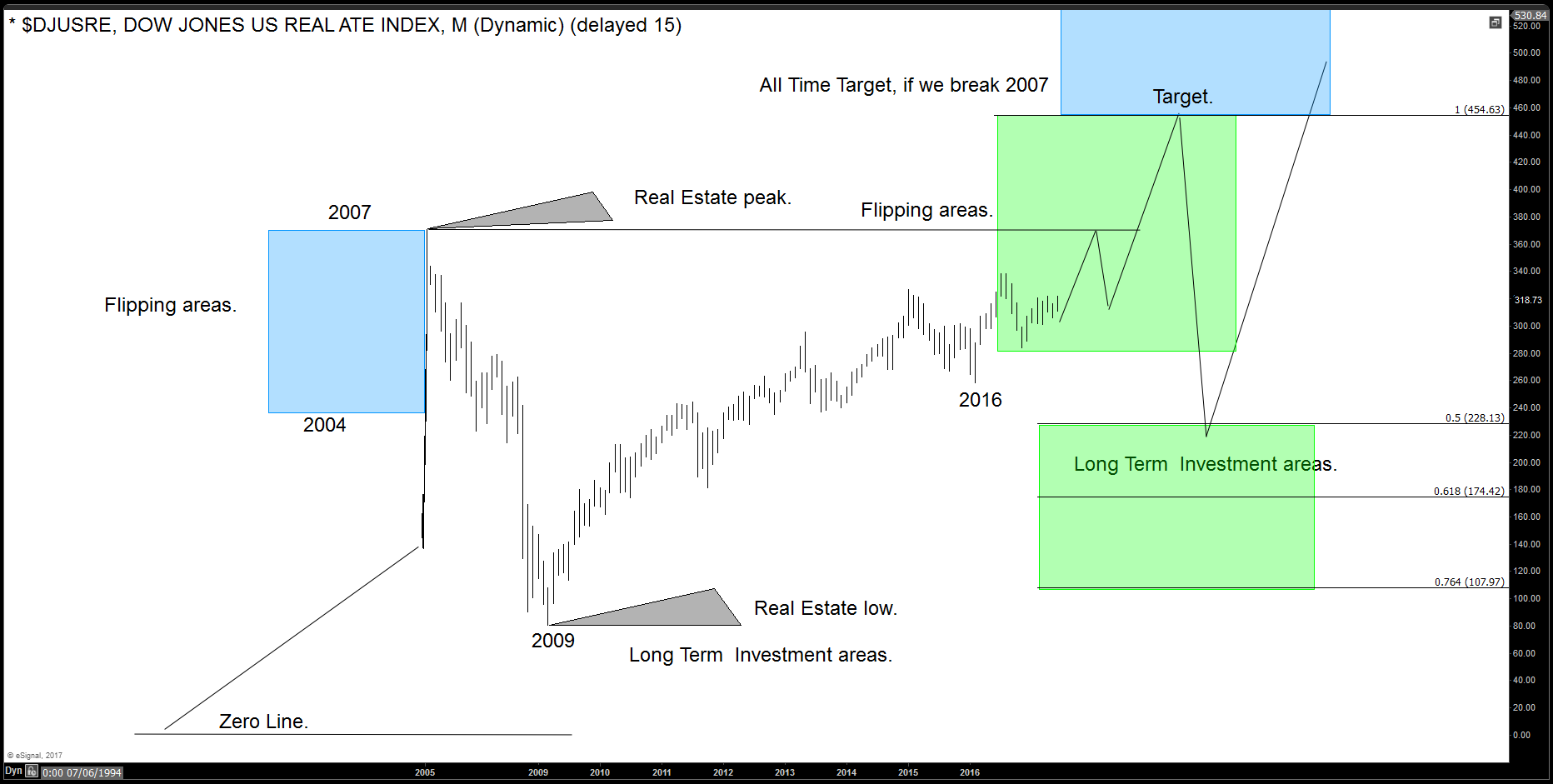

We track a lot of Indices around the World. One of the Indices we track is DJUSRE (Dow Jones US Real Estate Index) which provides a guideline for housing properties in the U.S. Buying real estate is always a good way to invest and make money. For years, investors use the real estate sector as one avenue of investment. There is an aspect which many people miss which is the timing. During the 2002-2006 period, prices of properties skyrocketed around the world and many people were able to make a quick profit and cash thousands of dollars out of the investment.

However, there were also many people who got trapped at the top and defaulted on the home loan because of the rapid decline in value and the obligation to the bank. When it comes to real estate, timing is everything and the method of buying also plays a role. There are two ways to buy properties, either using cash or bank’s mortgage. The difference between the two is the interest on the loan, either with a higher monthly payment or with an early penalty that can cost thousands of dollars.

The worst case scenario for an investor is buying at the peak using bank’s loan. During the 2008 – 2009 credit crisis, a lot of homeowners owe the bank more than the value of their homes as prices collapse driven by a speculative buildup of houses and subprime mortgage. If we drove around in 2010, we were able to see a lot of empty houses and buildings. Most of the buildings belong either to banks or associations.

DJUSRE (Dow Jones US Real Estate) Long Term Chart

(Click on image to enlarge)

Â

Looking at DJUSRE chart above, current real estate price is around the price in 2004-2005. When buying real estate you can do it for a flip or a long term investment. For a flip means that the investor will bet in a fast increase in value and then sell the property for a quick cash. Timing will play a big role when buying for a quick gain as it needs to be done at the proper time. Improper timing can leave investors with a bad investment or like many like to call under the water.