Annaly Capital Management (NLY) appears to be a tale of two stocks. On one hand, shares have soared 26% year-to-date. The company’s earnings-per-share rose significantly in 2016. Annaly followed this up, by turning a loss in the first quarter in 2016, into a profit in the first quarter this year. Investors cheered its first-quarter earnings report, in which a key metric—interest income—came in better than expected. However, Annaly’s dividends are going in the wrong direction. As a mortgage REIT, Annaly is being squeezed by rising interest rates. Annaly stock offers a sky-high dividend yield, of 9.5%. It is one of 416 stocks with a 5%+ dividend yield. You can see the full list of established 5%+ yielding stocks by clicking here.Â

While Annaly’s stock price performance and current dividend yield are certainly impressive, the company is facing a difficult fundamental outlook moving forward. As a result, this may not be the best time to buy Annaly shares. Investors who greatly desire high dividend yields, should also consider the risks before investing.

Business Overview

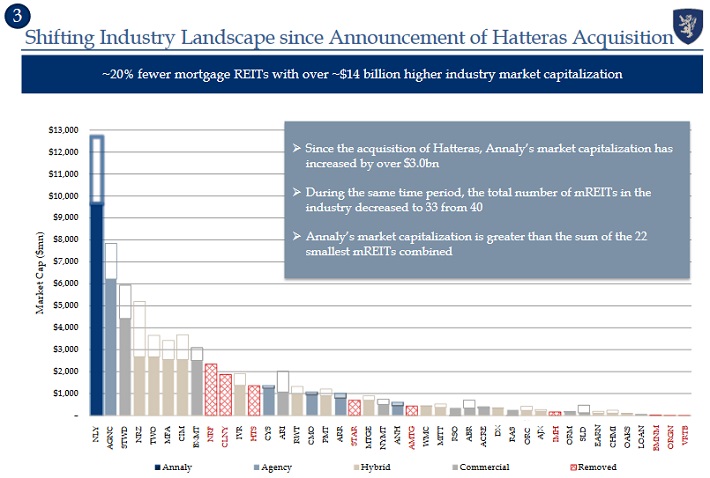

Most investors probably associate REITs with investing in real estate properties, but Annaly has a much different business model. It is known as a mortgage REIT—meaning it invests in mortgage securities. Annaly is the giant in the mortgage REIT industry. After its $1.5 billion acquisition of Hatteras Financial in 2016, Annaly now has a larger market capitalization than the 22 smallest mortgage REITs combined.

Source:Â JPM Securities Financial Services & Real Estate Conference, page 16

The company has approximately $90 billion in assets, and its portfolio includes securities, loans, and equity investments. It invests in both the residential and commercial real estate markets. Agency mortgage-backed securities represent the vast majority of Annaly’s assets:

- Agency Mortgage-Backed Securities (94% of assets)

- Residential Credit (3% of assets)

- Commercial Real Estate (2% of assets)

- Middle-Market Lending (1% of assets)