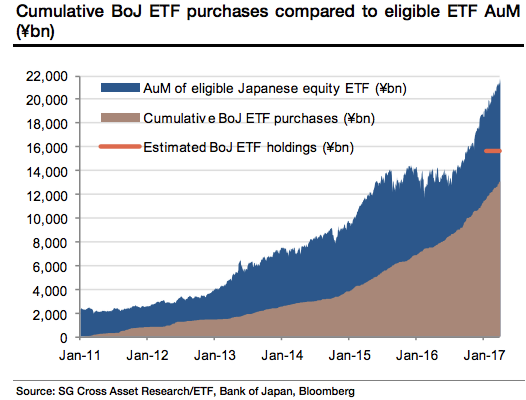

When last we checked the numbers on the “Tokyo Whale,†the Bank of Japan’s ETF holdings had ballooned 80% in the short space of 12 months to a cartoonish 16 trillion yen.

That would be “trillion†with a “t†and that total would represent something like three quarters of the entire Japanese ETF market:

(SocGen)

The truly hilarious part about that effort is the fact that something like 85% of ETF purchases announced by the BoJ have occurred on days where the TOPIX registered a negative return. In other words, they are literally “buying the fucking dip.â€

Of course, you shouldn’t lose sight of the fact that Kuroda has also cornered the JGB market to the point where, by some accounts, it barely even functions.

This week, courtesy of the latest BoJ flow of funds report, we learned that as of the end of March the bank owned nearly 40% of outstanding Japanese government bonds.

BOJ SAYS IT HELD 39.46% OF JGBS AT END-MARCH

— Walter White (@heisenbergrpt) June 26, 2017

That’s a lot.

And it’s up from 13.1% in 2013 before quantitative and qualitative easing (QQE) kicked off:

Here’s BofAML:

In April 2013, the BoJ began purchasing large amounts of JGBs under QQE. In the four years since then, the BoJ’s holdings of JGBs, excluding T-bills, have increased by ¥293trn to ¥387trn (Chart 2). After years of continual increase, this amounts to 40% of outstanding JGBs. The BoJ’s purchases are trending downward now, but they still outpace the net supply of JGBs by a wide margin. Although the rate of purchasing is likely to slow, the BoJ’s holdings will continue to expand. Banks (including Japan Post Bank) have reduced their JGB holdings by ¥124trn over the past four years, making them the main sellers, but they are gradually approaching the limit of their selling capacity. From the viewpoint of monetary policy sustainability, the introduction of YCC and the target shift from quantity to interest rates will become more meaningful with the passage of time.