Real estate has historically been a popular way to build and preserve wealth. However, buying, owning, and managing rental properties can be highly complex.

That’s why Real Estate Investment Trusts (REITs) offer a far simpler, more liquid way for regular investors to profit from this valuable industry.

Of course, REITs are also a highly specialized sector, one with many proprietary metrics that need to be understood to successfully navigate this high-yield industry Investors can learn more about how to invest in REITs here.

Let’s take a look at National Retail Properties (NNN), one of the best high-yield stocks here trading near a 52-week low, to see why if it has what it takes to help long-term income investors build their wealth and income over time.

Business Overview

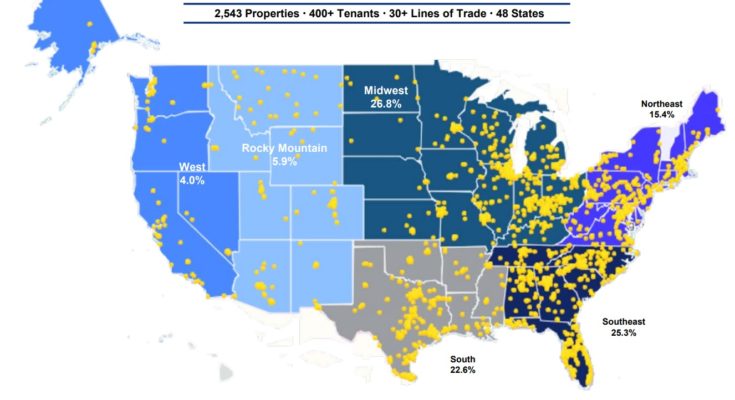

Founded in 1984 in Orlando, Florida, National Retail Properties is one of America’s oldest triple net retail REITs. Its diversified property portfolio of 2,543 stand-alone stores is spread out over 48 states and leased to over 400 tenants across more than 30 industries.

Â

Source: National Retail Properties Investor Presentation

While the rise of e-commerce giants like Amazon (AMZN) has devastated certain retailers, specifically in the apparel and mall sectors, National Retail’s tenants have very little direct exposure to this long-term secular trend.

In fact, National Retail leases none of its stores to apparel brands and has the vast majority of its properties leased under very long-term contracts (average remaining lease is 11.4 years) to tenants that either offer experiences or are relatively Amazon resistant, such as financially sound (i.e. strong rent coverage ratios) convenience stores, restaurants, and fitness centers.

Â

National Retail’s base of tenants is also nicely diversified, further reducing its risk. You can see that its largest tenant (Sunoco) accounts for 5.4% of total rent, and its top 10 tenants generate a reasonable 35% of rent. The company’s tenants are also in good financial shape overall with a weighted average rent coverage ratio of 3.8x.

Â

These factors have allowed National Retail Properties to enjoy some of the highest and most consistent occupancy rates (never below 96.4% since 2003), which results in very stable cash flow and highly secure dividends.

Â

Business Analysis

National Retail Properties would be a member of the dividend aristocrats list if it was large enough to be in the S&P 500 Index. This is impressive considering that there is currently only one REIT that is a dividend aristocrat, and National Retail actually has the 4th longest consecutive annual dividend growth streak in the industry.

Â

Not surprisingly, this remarkably consistent growth has resulted in impressive total returns over the past quarter century. In fact, National Retail Properties has greatly outperformed not just the S&P 500 and the vast majority of its REIT peers, but several other major benchmarks as well.

Â

Of course past performance is no guarantee of similar results in the future. However, there are plenty of reasons to be optimistic that National Retail Properties will continue to generate solid total returns in the years to come.

That’s because the business model is what’s known as triple net lease, meaning that the tenant pays all maintenance, insurance, and property tax costs. National Retail just owns the properties, which it leases to high-quality businesses for 15-20 year contracts with annual 1.5% rental increases to offset inflation.

Better yet? The company’s management team is very good at getting clients to renew their leases at the same or higher rent, creating incredibly consistent (thanks to well spaced out lease expirations) recurring cash flow from which to fund the steadily growing dividend.

Â

When leases are up for renewal, you can see that National Retail has rarely had to discount its leases or make substantial improvements to its properties to get tenants to stay (thanks to its triple-net leases, the company doesn’t have to “buy†higher rent with capital investments because tenants are on the hook for maintenance).

Â

National Retail has achieved these strong results for several reasons. First, the company intentionally owns properties with no anchor or co-tenancy issues. By owning single-tenant properties, tenants are unable to pool their bargaining power together to try and reduce their rent. National Retail’s main street locations also provide a strong market for replacement tenants and rent growth over time.

Finally, consumer-focused retailers also face more switching costs than an office or industrial customer because they are more location-driven; they don’t want to risk disrupting their established customer base to save a bit on rent, resulting in stronger renewal rates.

However, a high-quality, diversified property portfolio is just the beginning to National Retail’s success. In addition, management is constantly looking for new properties to acquire at highly favorable terms. That means acquiring properties for above average capitalization rates (operating net income/property price).