Policy convergence is a hot-topic these days, as hawkish comments from central bankers outside of the US and a relatively more benign econ backdrop in Europe have led markets to anticipate that the disconnect between Fed policy and ECB policy could begin to close. More simply, it’s looking likely that the UST-bund spread could narrow and further underpin the euro.

In that regard you kind of have to think there’s a lot of room for compression because let’s face it, bund yields are still absurdly low despite last week’s doubling and Treasury yields have had an awfully difficult time breaking sustainably to the upside as the nightmare in Washington has capped expectations for tax reform, fiscal stimulus, and really, this administration’s entire agenda.

The Fed is hiking but, a recent bout of steepening notwithstanding, the curve is getting flatter, which probably doesn’t presage anything good for the US economy.

Well, as we kick off H2, SocGen’s Kit Juckes has some thoughts on all of that and more, which we thought we’d share below…

Via SocGen

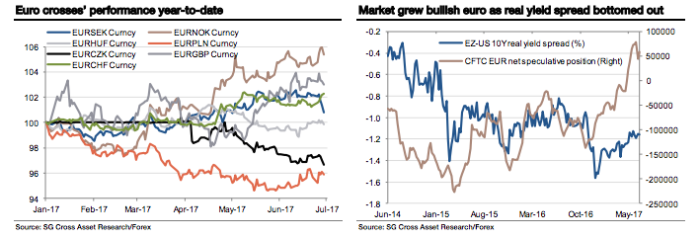

Transatlantic economic and yield convergence dominated the first half of the year and the FX market mirrored that move with the euro near the top of the rankings, against the US dollar near the bottom. In fact, the euro wasn’t the top of the currencies – that prize went to the recovering Mexican peso, followed by a selection of ‘euro-alternatives’, PLN, CZK, ISK and ILS. Nor was the dollar the worst of the bunch, with COP, BRL and ARS under-performing. But still, in a 6- month period when US yields fell, European ones rose, and Japanese ones did nothing, it was the EUR/USD move that caught everyone’s eye. We saw stronger equities and softer oil prices too.