EUR/USD

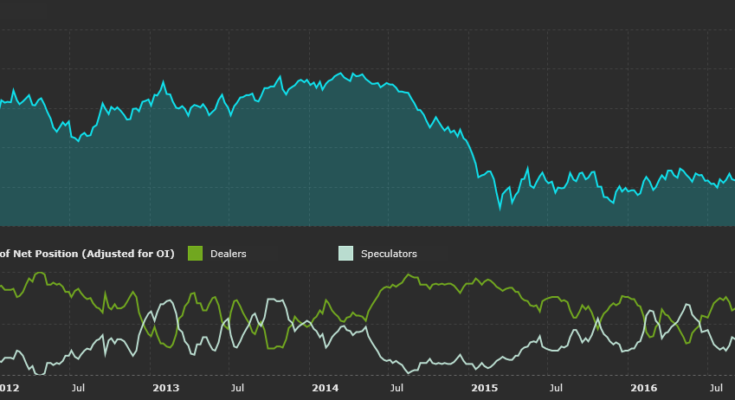

Non-Commercials increased their net long positions in the Euro last week buying a further 14k contracts to take the total position to 59k contracts. Following a near 50% reduction in long positions the prior week, EUR demand has resumed as market expectations have now shifted regarding the ECB’s monetary policy approach.

Following the ECB’s recent meeting which saw the bank striking a more neutral than dovish tone, ECB President Mario Draghi sparked a sharp rally midweek during the ECB forum. Draghi noted that the bank is no longer as concerned about low inflation, which they now view to be only temporary. Draghi’s comments come on the back of a series of increasingly positive economic releases from the eurozone and have further heightened investor expectations that the Bank is shifting back towards a tightening bias.

GBP/USD

Non-Commercials increased their short positions in Sterling last week selling a further 2k contracts to take the total position to -40k contracts. Selling pressure in GBP has eased over recent weeks as political uncertainty in the UK has dissipated.

Against a calmer political backdrop, the Bank of England has also indicated a shift towards a potential hawkish bias, further supporting GBP. The BOE governor recently commented that “some removal of monetary stimulus is likely to become necessaryâ€. These comments were reiterated by BOE economist Haldane who said that “we need to look seriously at the possibility of raising interest rates to keep the lid on those cost of living increasesâ€.

USD/JPY

Non-Commercials increased their net short positions in the Japanese Yen last week selling a further 12k contracts to take the total position to -62k contracts. Against a backdrop of other central banks in the G4 indicating a shift back towards a tightening bias, the BOJ have reaffirmed their commitment to maintaining their current policy stance as noted in comments made by BOJ board member Harada. In the absence of any key domestic data, this week JPY movement is likely to remain driven by this policy shift.