I’m getting a lot of questions about real estate right now and, specifically, about whether REITs are as “bad†as many investors think when rates are rising.

Nope.

In fact, the right REITs can be better, safer and potential far more lucrative as interest rates increase.

Including the two I’d like to share with you today.

Many investors believe that rising rates are bad for real estate and, by implication, for Real Estate Investment Trusts or “REITs†for short. So they’re starving themselves of badly needed income by lightening up their allocations or abandoning them entirely.

That’s a huge mistake – if you understand how to pick the right REITs.

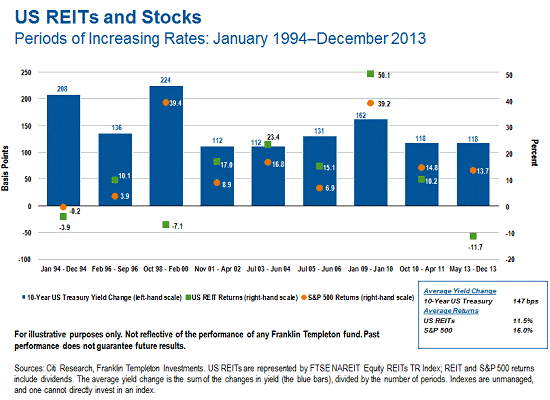

Contrary to what a lot of investors believe, REITs have historically done well when the cost of money is increasing. Between 1994 and 2017, for example, there were nine time periods when interest rates rose by more than 1% (or 100 basis points in trader speak) as measured by the 10-Year U.S. Treasury note.

Six out of nine of those times, REITs provided positive returns despite the fact that those rate changes were roughly four times larger than the measly 0.25% hike Yellen just made and the three additional hikes she says she’s going to make in 2017.

What most people miss is deceptively simple.

Namely that there’s a big difference between a sharp rate spike in the mold of Chairman Paul Volker’s 1970s “torpedo†and the slowest interest rate normalization in history that’s now Yellen’s legacy until, apparently, the end of time.

The former is a mechanism designed to shut down inflation and rein in speculation, while the latter is intended to maintain all the things policy makers believe free money makes possible – an improving labor market, consumer spending, and overall demand.

To paraphrase legendary executive and former presidential candidate H. Ross Perot, “lemme show ya a chart.â€

Many investors worry that “it’ll be different this time†– usually more as it relates to traditional dividends and income than real estate – but either way, it really doesn’t matter much.