TICC Capital Corp (TICC - Free Report) is a Zacks Rank #2 (Buy) and sports an “A†for value and momentum as well as a “C†for growth. Investors should put this stock on their radar screens right here after it has dropped about $1 per share over the last few weeks with the financials just starting to catch fire. A recent surge in price might also tell investors that it is bouncing off the bottom.

TICC is a business development company that provides capital to companies that are looking to grow organically or via acquisition. They also provide capital for recapitalizations or even working capital for everyday business needs. The company primarily uses debt and its deal sizes are between $5M and $50M.

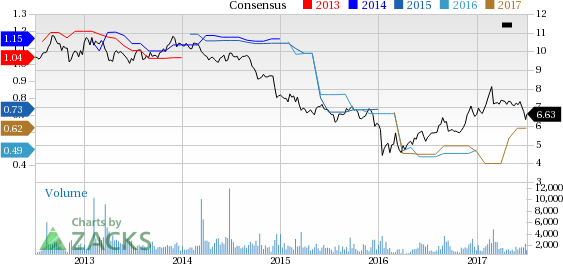

Earnings Estimates

Over the last sixty days, there were a few estimates that moved higher. Those revisions higher are the main reason the stock is a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for 2017 moved from $0.41 ninety days ago to $0.56 sixty days ago and is now at $0.62. That is quite a move in just 90 days, but it is exactly the type of thing you want to see in a stock you own.

Earnings History

The analysts seem to have this company figured out. Over the last four quarters, there was one beat, one miss and two meets of the Zacks Consensus Estimate. If I go back another four quarters I see the same pattern.

Valuation

I like what I see in terms of valuation. The stock trades at just 10x forward estimates and only 12x the twelve months trailing number. The price to book is 0.84x, meaning that we are getting true value here and by that, I don’t mean the hardware company. Basically, we are buying in at less than the cost of all the assets the company has. That is a great thing to see. Finally, the price to sales of 4.6x is rather stiff, but it helps balance out the other metrics which are very strong.

TICC Capital Corp. Price and Consensus

Â