Another new week, another day with not much going on. So much, or rather little so, that in its daily wrap Citi starts off with the following: “Pop Art pioneer Andy Warhol, who once said “I like boring thingsâ€, would have been a huge fan of today’s session thus far. Though several events of note linger on the horizon for later this week, G10 is firmly on the beach as of this morning.”

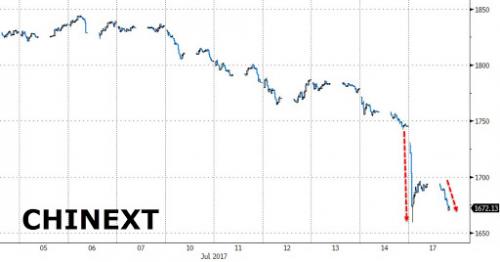

While it was indeed a generally quiet session (with Japan markets closed), US equity futures continued their run into record territory (ES up 0.1% to 2,458.50), and Europe fractionally lower, the early Monday focus was on the previously discussed turmoil for Chinese markets where despite a solid set of Chinese data small caps tumbled, selling off into the close after further warnings of regulatory scrutiny and deleveraging, and sending the ChiNext index of Chinese small caps down over 5% to the lowest level since January 2015.

European equity markets also weaker from the open, with the industrial sector underperforming after several Scandinavian companies fell heavily after earnings. Offsetting this was some early strength from mining stocks which lifted the FTSE 100 following the strong China indsutrial production and fixed investment data. Gilts rally, supporting bunds and USTs, unwinding Friday sell-off linked to rate-locking prior to expected corporate issuance, peripheral spreads also tighten. USD holds small overnight gains; NZD underperforms after dovish RBNZ comments overnight.

Benefiting from China’s strong data, Bloomberg reports that zinc and iron ore were the biggest winners and precious metals joined the advance. However, the jump in miners failed to spur the Stoxx Europe 600 Index, however, which reversed an advance as a report showed June consumer prices in the euro area were unchanged from a month earlier at 1.3%, missing “whisper estimates.” And while European data was largely in line with expectations, investors were reported to be locking in gains according to Bloomberg after a three-day rally and ahead of an ECB meeting this week. Stoxx Europe 600 index down 0.1% at 10:20 a.m. in London, was little changed before data, index rose toward 50-DMA earlier in session, but failed to cross above it. With underlying inflation still relatively weak, all eyes on ECB’s meeting this week when the central bank is expected to “hold fire” and wait until September before slowing the pace of its bond-buying program. The dollar strengthened against almost all its G-10 peers and was poised to end a five-day losing streak. Treasury yields slipped.

Outside of China, Asian shares hit a 2-year high overnight. As discussed, the previously discussed turmoil for Chinese markets, where despite the strong GDP data the Shanghai Composite Index retreated 1.4% amid concerns over the implications of a weekend meeting where President Xi Jinping said the central bank would play a greater role in defending against risks. The kiwi fell after the deputy governor of New Zealand’s central bank said a lower currency would help rebalance growth. Japanese markets were closed for Marine Day. South Korea’s Kospi Index advanced to an all-time high.

Not surprisingly, complacency has returned with the Citi global risk aversion macro index back to its pre-crisis average.

In currencies, the Aussie dollar hit its highest level in over two years before it pulled back to $0.7813, while the Canadian dollar touched a one-year high before it settling at around C$1.2659. Britain’s Sterling and the euro both eased against the dollar having jumped on Friday as officials from both sides prepared to for Brexit talks in Brussels. Specifically, the pound fell from a 10-month high against the dollar on concern that discord within the U.K. government is worsening before the nation starts the second round of Brexit negotiations with the European Union. Sterling snapped a three-day advance ahead of the talks that are likely to focus on protecting citizens’ rights, which has been a key sticking point so far, Bloomberg reports. The Chancellor of the Exchequer Philip Hammond exposed tensions within the British cabinet at the weekend by stating that transitional arrangements at the end of talks are likely to last a couple of years, far longer than the couple of months suggested by Trade Secretary Liam Fox.

In commodities, oil rose again following the Chinese data, extending gains made last week on signs of lower U.S. inventories and stronger demand. U.S. crude rose 0.3 percent to $46.66 a barrel, while global benchmark Brent added 0.3 percent to $49.07.Gold gained too, rising to $1,229.90 an ounce in London, though it was copper that shone brightest of the metals as it climbed 1 percent to $5,983.50 a tonne, having earlier struck its highest since March 2.

“I’m still bullish on copper. The property backdrop is still good; China economy and industrial production numbers are still good. Orders are coming through from state grid,” said analyst Dan Morgan at UBS in Sydney.

In rates, the 10Y held steady at 2.31%, after dropping as much as 2.279% on Friday as the dollar inched 0.1% higher versus the yen to 112.635 yen. Eurozone govt bonds also barely budged, biding their time ahead of this week’s European Central Bank meeting for the latest signals on how the central bank plans to scale back its ultra-loose monetary policy. The Bank of Japan too is expected to keep its ultra accommodative policy unchanged when it meets on Wednesday and Thursday. Germany’s benchmark 10-year bond yield was at 0.52 percent – down from 18-month highs of 0.58 percent hit a week ago.

Today focus will also shift to earnings season, which will ramp up with the likes of Microsoft Corp. and Unilever set to report.

Top overnight news

- Eurozone Jun. F CPI unrevised y/y: 1.3%; Core CPI unrevised 1.1%

- U.K. Chancellor Hammond: transitional period on Brexit deal is likely to be “couple of years,†rather than “couple of months

- Italian Finance Minister: Italy has exited the tunnel of crisis; government will soon revise growth estimates upward

- China 2Q GDP 6.9% vs 6.8% est; Jun. Retail Sales 11.0% vs 10.6% est; Industrial Output 7.6% vs 6.5% est.

- China weekend meeting on finance founds new panel, boosts PBOC

- Turkish senior adviser: army is preparing for action against Kurdish-run region of Afrin on Syrian border; military buildup on the border is “serious”

- China’s Growth Beats Amid Reforms; Trump’s Approval Rating Slumps; U.A.E. Orchestrated Qatar Attacks

- China’s economy grew faster than expected in the second quarter, putting the nation on track to meet its growth target this year and giving backing to officials in their campaign to corral oncoming financial risk

- President Donald Trump is planning to shake up his legal team and is also evaluating options for his communications shop as the FBI and congressional investigations into his campaign’s possible ties to Russia heat up

- Senate Republicans anxiously awaiting a key analysis of their revised health bill have more time to wait, and debate on the controversial measure that had been expected this week will also be delayed following a medical scare involving one of its potential backers

- Green Courte Partners, a private equity and real estate investment firm, is considering a sale of parking operator The Parking Spot

- Amid a stalled turnaround, General Cable Corp. said it’s hired investment bank JPMorgan Chase & Co. to pursue a potential sale of the company

- The European Central Bank is on track to unwind its stimulus next year but it’s likely to drag out the process, economists say

- China plans to punish billionaire Wang Jianlin’s Dalian Wanda Group Co. for breaching the nation’s restrictions on overseas investments by cutting off funding and denying the conglomerate with necessary regulatory approvals