Real Estate Investment Trusts are popular investments among income investors, for obvious reasons.

They are required to pass along the vast majority of their earnings in order to retain a favorable tax structure, which results in some eye-popping yields across the REIT asset class.Â

For example, Whitestone REIT (WSR) has a 9% dividend yield, which is more than four times the average dividend yield in the S&P 500 Index.

It is one of 405 stocks with a 5%+ dividend yield.Â

Not only does it have a very high dividend yield, but it also makes its payments each month.Â

Stocks with such extremely high yields can also carry significant risk. As a result, it is critical for investors to make sure the high dividend payouts are sustainable over the long term.

This article will discuss Whitestone’s business model, and whether its dividend is covered by sufficient cash flow.

Business Overview

Whitestone is a commercial REIT. Its properties are located primarily in the South:

- Phoenix (50% of operating profit)

- Houston (20% of operating profit)

- San Antonio/Austin (20% of operating profit)

- Dallas (9% of operating profit)

- Chicago (1% of operating profit)

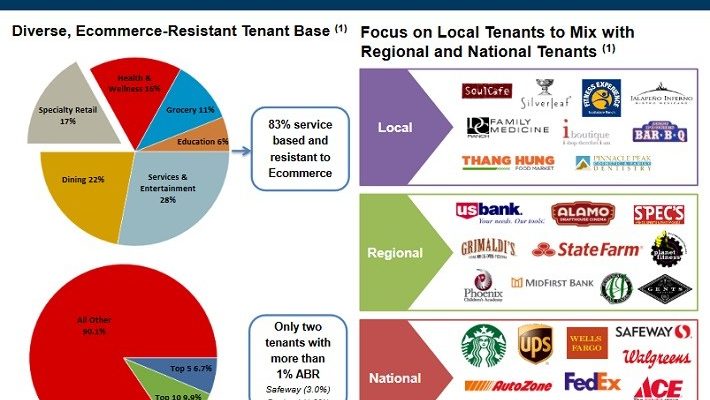

Whitestone’s focused strategy is a competitive advantage. It primarily invests in destination centers, such as grocery stores, retail outlets, banks, restaurants, and many more.

As of March 31st, 2017, Whitestone’s portfolio consisted of 69 properties, with over 1,500 tenants. It has a solid occupancy rate of 89%.

Source:Â June 2017 Investor Presentation, page 17

Whitestone believes its investment properties are “e-commerce resistantâ€, because they are go-to destinations that provide needed or necessary centers. Moreover, the company believes these are products and services that are not readily available online.

And, these properties are located in densely-populated, high-income areas, which are experiencing strong growth.