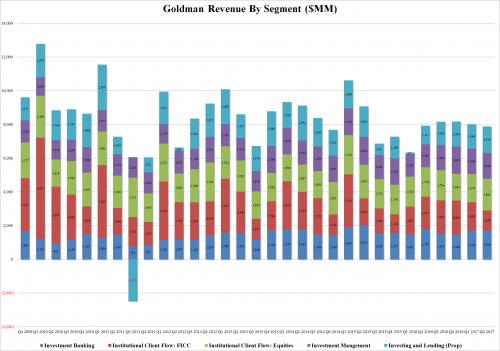

While Goldman’s (GS) overall results reported moments were generally solid, with the bank reporting Q2 revenue of $7.89 billion (exp. $7.52 billion) and net earnings of $1.83 billion, or EPS of $3.95, above the $3.39 expected, compared with $3.72 for Q2 of 2016 and $5.15 in Q1 2017, there was just one number everyone was focused on: the bank’s most profitable segment, its FICC revenue, which however was painfully disappointing, at just $1.159 billion, down 40% Y/Y and roundly missing expectations of $1.47 billion, the bank’s worst performance in this segment going back to Q4 2015. Also, despite the top-line beat, overall Goldman revenues were the lowest going back to Q1 2016.

Breaking down the key revenue segments:

- 2Q trading rev. $3.05 billion, est. $3.13 billion

- 2Q FICC sales & trading revenue $1.16 billion, est. $1.47 billion

- 2Q equities sales & trading revenue $1.89 billion, est. $1.71 billion

- 2Q investment banking revenue $1.73 billion, est. $1.59 billion

And visually:

Discussing the disappointing performance, Goldman said: “net revenues in Fixed Income, Currency and Commodities Client Execution were $1.16 billion for the second quarter of 2017, 40% lower than the second quarter of 2016, due to significantly lower net revenues in interest rate products, commodities, credit products and currencies, partially offset by higher net revenues in mortgages. During the quarter, Fixed Income, Currency and Commodities Client Execution operated in a challenging environment characterized by low levels of volatility, low client activity and generally difficult market-making conditions“

Offsetting the poor performance in the high-margin FICC group was the spike in equities, which however is a far lower margin segment. This is what Goldman said: “net revenues in Equities were $1.89 billion for the second quarter of 2017, 8% higher than the second quarter of 2016, primarily due to higher net revenues in equities client execution, reflecting higher results in both cash products and derivatives. Net revenues from securities services and commissions and fees were both slightly higher compared with the second quarter of 2016. During the quarter, Equities operated in an environment characterized by generally higher global equity prices, while volatility levels remained low.”