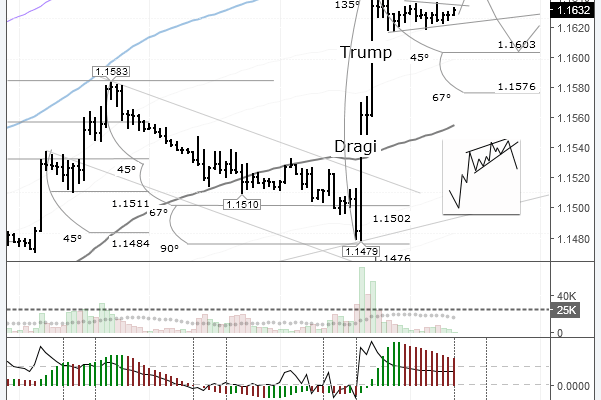

Yesterday, trading on the euro/dollar pair closed up. By the end of the day, the euro had appreciated by 115 pips against the dollar, reaching 1.1630. The rate had dropped to 1.1479 before Mario Draghi’s press conference.

The European Central Bank decided to maintain rates at their current levels. The base rate remains at zero, the marginal rate at 0.25% and the deposit rate at -0.4%. The ECB also reiterated that their assets purchasing program would be maintained at 60bn EUR a month at least until December this year.

There was an increase in market volatility during Draghi’s speech. His comments were neutral, but they nevertheless triggered a strengthening of the euro across the market. At the press conference, Draghi talked about the improved economic performance seen across the European region. He also said that the regulator hadn’t discussed measures that might be taken in the near future or after September. He also gave no hint of the upcoming reversal of quantitative easing, but word from the regulator that the program’s future might be discussed in the autumn triggered a euro rally, pushing the rate up to 1.1570.

An hour later, the euro/dollar rate shot up to 1.1657. This was brought about by a weakening of the US dollar across the market. The dollar fell after it was revealed by Bloomberg that Robert Mueller, the man in charge of the probe investigating Russian interference in the US election, would start looking at Trump’s business dealings with Russia, as well as those of some of Trump’s close associates. After hitting its high, the euro corrected to 1.1618, after which the pair started trading flat.

Day’s news (GMT+3):

- 11:30 UK: public sector net borrowing (Jun);

- 15:30 Canada: CPI (Jun), CPI core (Jun), retail sales (May);

- 20:00 USA: Baker Hughes US oil rig count.

EUR/USD rate on the hourly. Source: TradingView

Mario Draghi probably didn’t imagine there would be such a reaction to his comments. With the single currency strengthening and with low oil prices, the ECB missed its inflation target. Draghi reiterated that the central bank could make the necessary changes to the QE program even if economic conditions get worse. No one has reversed QE yet, though, and euro bulls have already set themselves targets of 1.1826 and 1.2275.