The EUR/USD’s ascent began in earnest after the result of the first round of the French election was sealed. The pair opened almost a cent and a half higher on the Monday after the election, rewarding euro bets the protectionist Le Pen would be the loser and the euro-centric Macron would push ahead with his pro-business agenda following his victory.

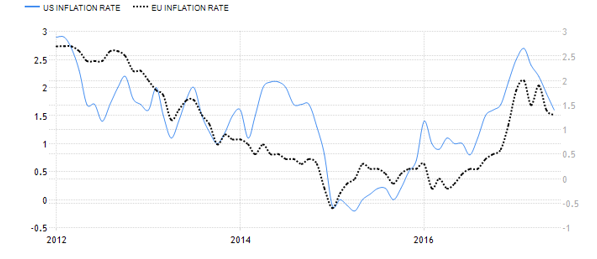

In the 3 months following, the euro has relentlessly marched higher and is now 8 cents higher at 1.660 against the US dollar. Should it rise further and surpass 1.72, it will settle at a level not seen since January 2015. This feat is impressive because the ECB has not indicated any imminent deviation from its loose monetary policy nor has the Fed indicated that it’s tightening cycle is over. True, economic data coming out of the USA is weak and there are strong indications the Euro economy is on the mend, however inflation in the Euro zone is still weaker than the US and both inflation rates have been declining since January this year. At the very least, a halt to both monetary policies should be reflected by a stable EUR/USD. So why has the Euro been tirelessly strengthening? It’s all about inflation, right?

Perhaps it’s because the market does not believe the ECB (and its hidden agenda of keeping the euro suppressed) that despite Draghi pronouncements, tapering will indeed be announced in the coming months. Perhaps the Euro GDP growth rate is now persistently stronger than that of the US and that they are truly diverging.

Perhaps despite the November 2016 election of Trump with his pro-business policies, spirits in the US economy have yet to awaken. The strengthening euro zone economy indicates growing balance of trade whilst the US economy seem to be falling away. This implies a stronger demand for the euro to pay for European exports.

Perhaps it’s the strengthening Euro manufacturing sector, rising euro consumer confidence, rising Euro economic sentiment or rising euro construction spending, all of which are diverging from US data.