Nasdaq 100 futures jumped 0.8% after Apple surged to record highs following a strong beat and optimistic projections ahead of the launch of the company’s new batch of iPhones. E-minis are little changed, up 0.1% to 2,475, trailing Asian markets, while European stocks and crude oil fall.

Apple surged 6% after-hours to a new record highm taking its market capitalization above $830 billion. That should help carry the Dow through the 22,000 mark when the market opens. Among Asia’s Apple suppliers, LG Innnotek jumped 10 percent and SK Hynix, the world’s second-biggest memory chip maker, rose 3.8 percent. Murata Manufacturing firmed 4.9 percent and Taiyo Yuden 4.4 percent, helping the Nikkei up 0.47 percent.

“It is all about Apple,” said Naeem Aslam chief market analyst at Think Markets. “The firm comfortably topped its forecast and produced stellar numbers for its revenue and profit.”

Oil came under pressure again as higher than expected US inventories and reports of rising OPEC output helped drive prices below back below $48/bbl (WTIcrude). In FX markets, the USD dollar gave up some gains late in the session with DXY edging down by 0.1% and the euro rising to $1.1827. Treasury yields are 0.5-2bps higher across the curve with the 10y at 2.273%.

The MSCI tech index for Asia climbed 0.9 percent to ground not trod since early 2000, bringing its gains for the year to a heady 40 percent. Asian markets rose, supported by tech shares after Apple’s surprising beat guidance boost as well as stronger Chinese manufacturing PMIs (the Caixin/Markit survey of private Chinese manufacturing rose to 51.1 in July, its highest level in four months). Japan’s Nikkei gained after the strong Apple sales outlook helped boost tech shares; Korea’s Kospi and the Hang Seng were also firmer while the ASX 200 slipped on commodities pullback. The NZ kiwi dropped sharply after New Zealand’s employment unexpectedly fell. Australian government bonds trimmed early gains after monthly building approvals surged; WTI crude futures drift lower toward $48.50; Dalian iron ore January futures 1.6% weaker

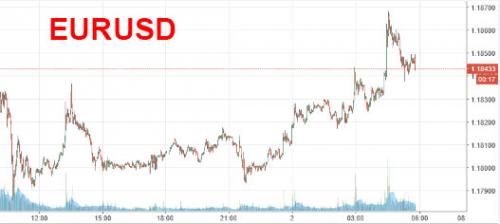

In Europe, the Stoxx Europe 600 Index declined 0.2%, the U.K.’s FTSE 100 Index decreased 0.3 % while Germany’s DAX Index dropped 0.1%. Mining and oil shares weighed on Europe’s benchmark equity index as crude fell for a second day and most industrial metals traded lower. Meanwhile, following its best month since March 2016 the Euro’s gains continued, reached a new two-and-a-half-year high against the ailing dollar, and leading to a stop-loss triggered spike around 4:30am ET, which sent the EURUSD as high as 1.1870, pressuring the Eurostoxx 600 lower, as traders trimmed long-dollar positions ahead of U.S. payrolls data on Friday. Rio Tinto Plc led the decline among basic resources shares after first-half profit missed estimates. Banks dropped after Standard Chartered Plc said it can’t resume dividends amid an uncertain recovery, while Societe Generale SA slumped as litigation costs increased. Oil extended a retreat from its brief rise above $50 a barrel as U.S. crude stockpiles expanded, while copper dropped a second day.

“The ECB is going to be the central bank to watch for the rest of the year,” said JP Morgan Asset Management global market strategist Alex Dryden. “We think they are going to take 9-12 months to get out of the market but that is a big question … it could even be six months,” he added.

With the dollar index near a two-year low, the options market shows that traders are gearing up for more euro strength with demand growing for calls, according to Bloomberg. The currency’s strength has pushed European earnings revisions into negative territory, according to Credit Suisse Group AG.

The pound retains bullish trading ahead of the Bank of England policy decision on Thursday, rising as high as 1.3240. European government bonds slipped before Germany’s sale of 10-year bunds, which priced at an average yield of 0.49%, down from 0.59% previously (Bid to cover 1.52, retention of 19.5%).

The key overnight FX move included a tumble in the New Zealand dollar, which fell more than half a percent after second-quarter employment unexpectedly declined. Most emerging Asian currencies fell initially as the dollar recovered after capping a fifth straight month of declines in July. The MSCI EM Asia Index of shares is up for a third day, with bonds in the region mostly higher. However, as the night progressed, dollar gains fizzled and the Bloomberg Dollar Index was down less than 0.1% after bing up 0.1% earlier, following Tuesday’s 0.2% advance, which came after a sharp 2.6% slide in July.

China’s money-market squeeze returned, with sovereign bonds beginning to feel the heat as the central bank keeps liquidity on a tight leash, without adding any net new reverse repo liquidity for another day, and concerns grow about a wall of fund maturities this month. 10-year bond yield little changed at 3.64%, hovering near the highest level in 8 weeks as PBOC refrains from boosting liquidity for third day. Onshore, offshore yuan both drop; Shanghai Composite Index down 0.2%. In a statement on its microblog, SAFE said it didn’t target specific companies as in a media report that it checked their collaterals for loans overseas.