BlackRock is the largest asset manager in the world, and as of the most recent quarter, they have $5.7 trillion in assets under management (AUM).

They own the leading iShares brand of ETFs and have a massive institutional asset management business that includes both passive and active investment funds and services.

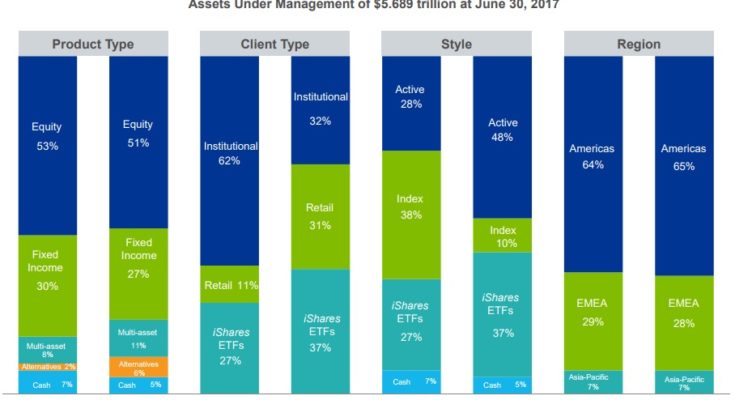

Here’s a breakdown of where their AUM and fees are derived, and you can click the image for a bigger view:

(Click on image to enlarge)

Source:Â Q2 2017 BlackRock Earnings Supplement

And here’s a chart of where their revenue is derived:

Source: Q2 2017 BlackRock Earnings Supplement

BlackRock’s Headwinds

BlackRock (NYSE:Â BLK) has massively outperformed the market since its IPO in 1999, but with a rich price-to-earnings ratio of over 20, BlackRock now faces some headwinds.

First of all, with such a large scale already achieved, some people doubt BlackRock’s continued ability to grow their $5.7 trillion in AUM at a decent pace. Most of their revenue comes from fees derived from their AUM, and that continues to require market growth and/or capital inflows to continue to expand.

Secondly, investors are increasingly shifting to passive investments. Moody’s Investors Service estimates that passive funds constitute 28% of assets under management in the United States today, and that this will expand to 50% within the next 4-7 years. Blackrock is on both sides of that divide; passive and active. As you can see in the chart above, only 28% of BlackRock’s AUM is in active investment, but 48% of their fees come from that segment. The margins there are much more attractive than for passive investing.

And as active management becomes less popular, BlackRock will cannibalize the most profitable part of its business with the less profitable part of its business. It’s not as bad as it is for pure-play active managers, but for BlackRock it’s still not a great scenario.  As perhaps the most extreme example, BlackRock manages most of the Thrift Savings Plan for federal employee and military investors, and charges an average expense ratio of just 0.039%. Institutional and passive management just isn’t that profitable.