Previous:

Trading on the euro/dollar pair on Monday closed 0.19% up. After restoring to 1.1814, the euro fell to 1.1781. Sellers were unable to breathe further life into the downwards impulse against the growth on the euro/pound cross during the US session. Trading closed at 1.1795. The economic calendar was empty, so there was low activity on the market up until the Asian session.

Day’s news (GMT+3):

- 08:45 Switzerland: unemployment rate (Jul).

- 09:00 Germany: trade balance (Jun).

- 13:00 USA: NFIB business optimism index (Jul).

- 15:15 Canada: housing starts (Jul).

- 17:00 USA: JOLTS job openings (Jun), IBD/TIPP economic optimism (Aug).

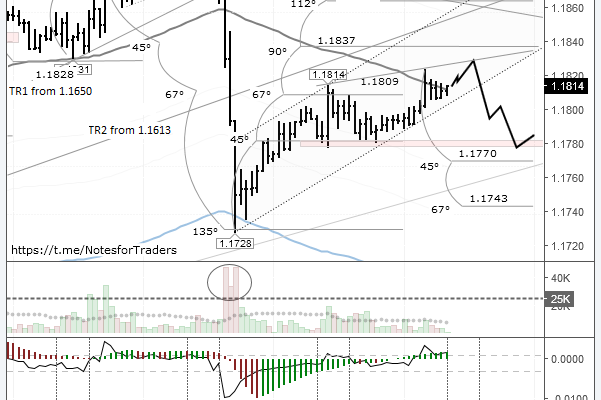

EUR/USD rate on the hourly. Source: TradingView

The 67th degree from the 1.1728 low acted as a temporary resistance. Sellers managed to stop buyers at 1.1814, but weren’t able to do the same during trading in Asia this morning as Australian statistics were released. The upwards dynamics of the AUD/USD pair acted as a trigger for the dollar’s slide against other currencies. After the release of Chinese data, the Aussie rate fell, but other currencies continued to trade up against the dollar.

The correction from the drop from 1.1889 to 1.1728 is currently at 61.8%. The price is currently sitting on the LB line. The market is ready for some strong movement. The question is, in which direction? I first predicted that the euro would drop from its current level to 1.1763 (trend line), then I changed my forecast to predict a rise 1.1828 followed by a drop to 1.1778. I didn’t like the look of the US 10Y bond hourly chart, which has been trading within a narrow corridor for several hours. It’s very easy to push the price down here, where there are also plenty of willing sellers for the dollar. If this happens, the euro will definitely not fall. If, from when trading opens in Europe, the euro/dollar pair immediately starts falling, as a target, we can take 1.1763 level, just under the 45th degree. A drop below 1.1803 would be a good sign for sellers (breakout of the trend line from the upwards movement from 1.1728). I really hope that the rate falls today without any delay; otherwise we could see a new rally with renewed strength.